Deokyang Energy

Deokyang Energen (Ticker: 0001A0 KS) is a South Korean company specializing in the manufacture of pure, mixed, and other industrial gases. Headquartered in Yeosu, the company is a specialized hydrogen purification enterprise that primarily utilizes by-product hydrogen from chlor-alkali and petrochemical processes. It employs high-level purification technology to produce 99.99% high-purity industrial hydrogen, which is reportedly supplied to major domestic refineries and downstream petrochemical companies via pipeline and tube trailers.

The company plans to list on the KOSDAQ on January 30, 2026. Deokyang Energen is offering 7,500,000 shares (comprising 90.01% new share issuance and 9.99% secondary sale) with an expected price range of KRW 8,500 to KRW 10,000. At the top end of the range, the IPO would raise KRW 75.00 billion (approximately USD 51.09 million). The offering is managed by NH Investment & Securities and Mirae Asset Securities. According to company filings, the transaction includes specific lock-up agreements, including a 30-month period for the largest shareholder and a one-year period for the employee stock ownership plan.

Eastroc Beverage Group

Eastroc Beverage Group Co Ltd (Ticker: 9980 HK) is a Chinese company specializing in the non-alcoholic beverage sector, best known for its flagship functional energy brand, "Eastroc Super Drink". The company plans to list on the Hong Kong Stock Exchange on February 3, 2026. Eastroc plans to offer 40.89 million shares at a price of HKD 248.00, raising approximately HKD 10.14 billion (USD 1.30 billion).

Headquartered in China, Eastroc is a dominant player in the local energy drink market, reportedly ranking third in market share behind Red Bull and Hi-Tiger. The company is already listed on the Shanghai Stock Exchange (605499) and reportedly generated over 10 billion in revenue in 2023, reflecting a compound annual growth rate of more than 20% in revenues from 2018 to 2022. The IPO is reportedly managed by underwriters including Huatai Financial Holdings, Morgan Stanley Asia, and UBS. This listing marks a continued expansion for the group, which has reportedly solidified its position as a leading multi-category beverage manufacturer with comprehensive sustainability and production capabilities in the region.

Gon Technology

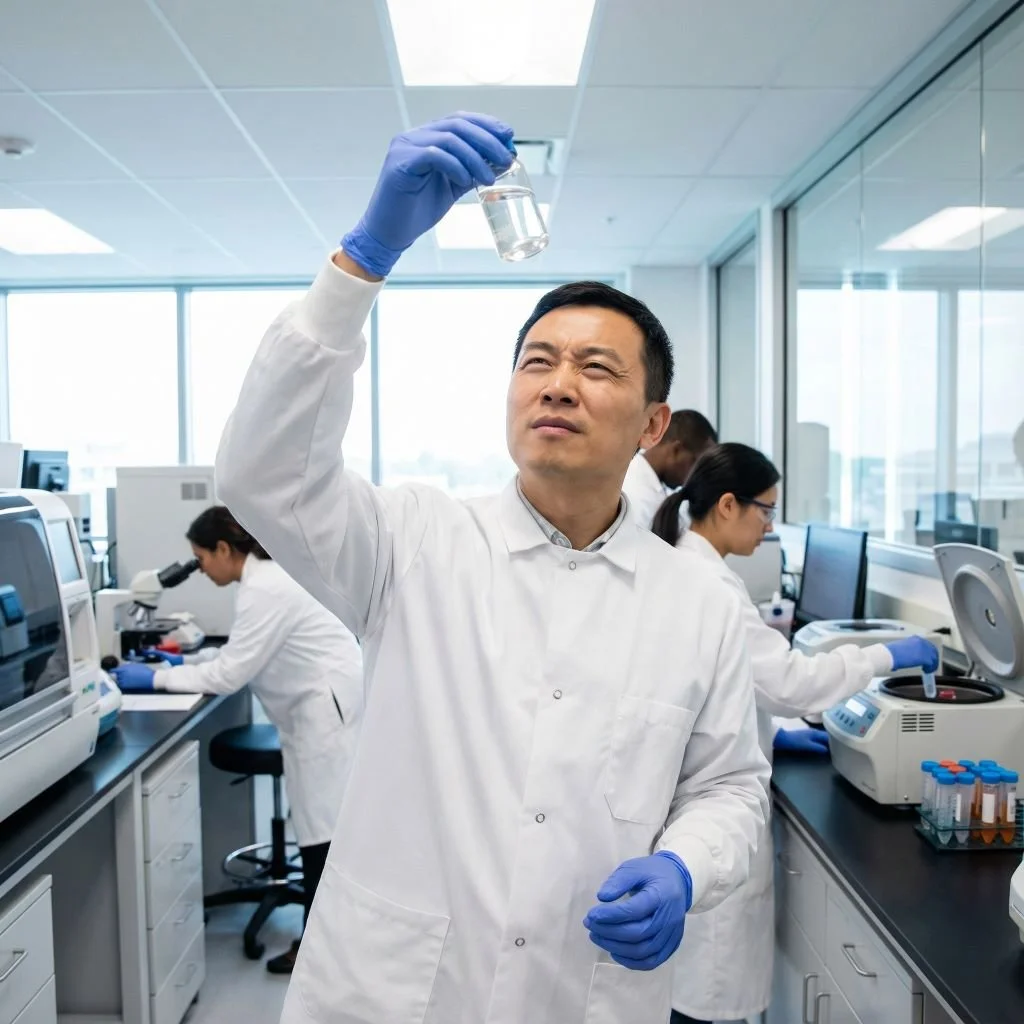

Gon Technology (Ticker: 2768 HK) is a Chinese company specializing in the research, development, and production of new chemical materials and collagen-based health products. The company plans to list on the Hong Kong Stock Exchange on February 4, 2026. Gon Technology intends to offer 30 million shares at a price range of HKD 34.00 to HKD 42.00, aiming to raise up to HKD 1.26 billion (approximately USD 162 million). At the upper end of the price range, the company targets a market capitalization of HKD 12.65 billion (USD 1.62 billion).

Operating as a diversified supplier, Gon Technology serves industries ranging from automotive and home appliances to pharmaceuticals. The company reportedly ranks as China’s largest polystyrene enterprise by production capacity and the second-largest producer of bone gelatin. Its dual-engine business model covers green petrochemicals and organic polymer composites, alongside a health segment focused on gelatin and empty capsules. According to listing documents, Gon Technology plans to use the IPO proceeds for R&D, expanding production capacity, brand promotion, and strategic acquisitions. The offering is being managed by underwriters including China Merchants Securities, CICC, and CLSA.

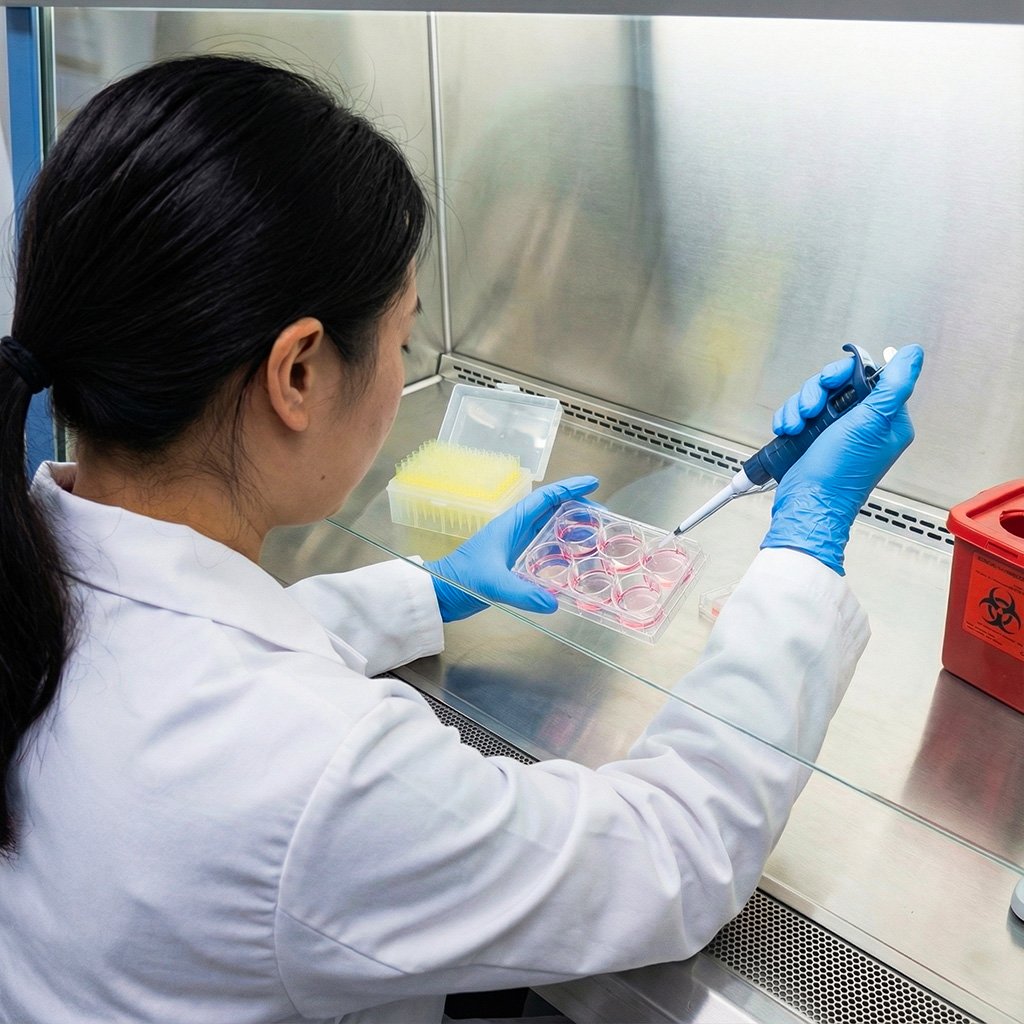

Eikon Therapeutics

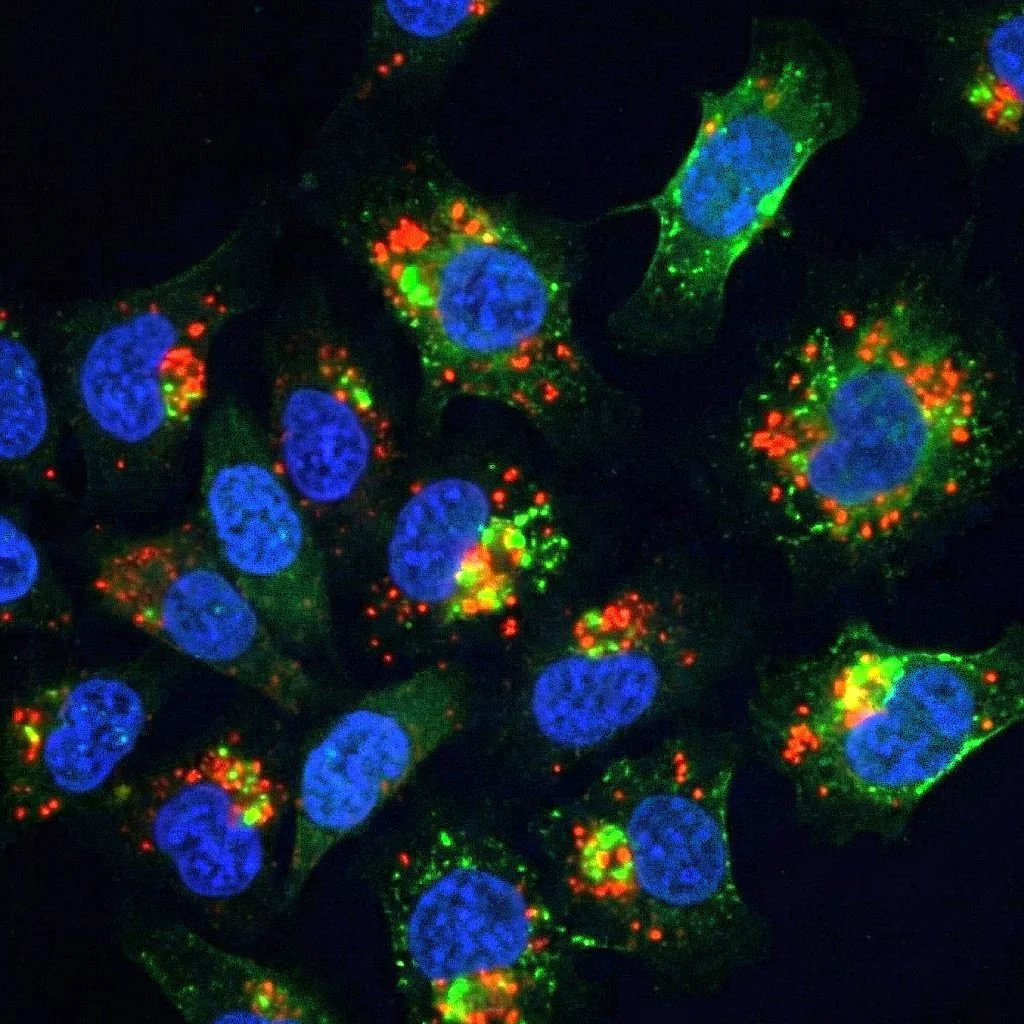

Eikon Therapeutics, Inc. (Ticker: EIKN US) is a U.S. biopharmaceutical company specializing in the development of innovative medicines for serious unmet medical needs, with an initial focus on oncology. The company plans to list on the NASDAQ on February 5, 2026, offering 17,648,000 shares at a price range between $16.00 and $18.00. At the midpoint of this range, the IPO is expected to raise approximately $300 million. Eikon Therapeutics targets a valuation of up to $908.2 million.

According to the company, the proceeds from the IPO are intended to advance its clinical pipeline, which includes the mid-to-late stage drug candidate EIK1001. The company utilizes a high-throughput drug discovery platform based on the work of Nobel Prize-winning co-founder Eric Betzig and is led by Dr. Roger M. Perlmutter, a former research chief at Merck. The offering is managed by a bookrunning group including J.P. Morgan, Morgan Stanley, BofA Securities, and Cantor. Since its founding in 2019, the company has reportedly raised over $1 billion from private investors such as Lux Capital and Foresite Capital.

Bob's Discount Furniture

Bob’s Discount Furniture, Inc. (Ticker: BOBS US) is a U.S.-domiciled, national omnichannel retailer of value home furnishings. The company operates a network of 206 showrooms across 26 states, offering a curated "Good, Better, Best" product assortment anchored by an "Everyday Low Prices" strategy. Bob’s Discount Furniture plans to list on the NYSE on Thursday, February 5, 2026. The company intends to offer 19,450,000 primary shares within a price range of $17.00 to $19.00 per share.

At the midpoint of the range, the IPO aims to raise approximately $350 million USD. The offering is led by J.P. Morgan and Morgan Stanley. Upon completion, the company will remain a "controlled company" majority-owned by Bain Capital. According to the filings, Bob’s Discount Furniture plans to use the net proceeds to prepay outstanding indebtedness under its Term Loan Facility, funds which were reportedly utilized to pay a cash dividend to stockholders in October 2025, and for general corporate purposes.

Forgent Power Solutions

Forgent Power Solutions, Inc. (Ticker: FPS US) is a United States-based company specializing in the design and manufacture of electrical distribution equipment for data centers, the power grid, and energy-intensive industrial facilities. The company focuses on engineered-to-order custom products to support demand in cloud computing, AI, and electrification. Forgent Power Solutions plans to list on the New York Stock Exchange on February 5, 2026, planning to offer 56,000,000 shares at a price range of $25.00 to $29.00 per share. The offering is expected to raise approximately $1.51 billion at the midpoint, with a maximum size of roughly $1.62 billion in USD.

According to the prospectus, Forgent Power Solutions plans to use the net proceeds from the IPO to redeem interests in an operating subsidiary held by existing equity owners controlled by Neos Partners, LP. Consequently, the company reportedly will not retain capital for general corporate operations from this transaction. The offering includes both primary shares and secondary shares sold by parent entities. Lead underwriters for the transaction include Goldman Sachs, Jefferies, and Morgan Stanley. The company reported revenue growth of 56% for the fiscal year 2025.

Once Upon A Farm

Once Upon a Farm, PBC (Ticker: OFRM US) is an American company specializing in the manufacturing, distribution, and marketing of fresh, organic, and nutrient-packed food products for babies and children. The company plans to list on the NYSE on February 6, 2026. The IPO involves an offering of 10,997,209 shares within a price range of $17.00 to $19.00, aiming to raise approximately $198 million USD (at the midpoint).

The deal structure comprises 7,631,537 primary shares and 3,365,672 secondary shares, indicating that proceeds will reportedly be split between the firm and existing selling shareholders. Organized as a Public Benefit Corporation, the company focuses on "farm fresh first" nutrition, offering cold-pressed pouches, frozen meals, and snacks free from added sugar and preservatives. Co-founded by John Foraker and actress Jennifer Garner, the brand utilizes an omnichannel strategy, selling through direct-to-consumer platforms and over 20,000 retail locations, including Target and Whole Foods. J.P. Morgan and Goldman Sachs are serving as joint lead bookrunners for the transaction.

PicPay

Picpay Holdings Netherlands B.V. (Ticker: PICS US) is a Netherlands-incorporated holding company operating PicPay, a leading Brazilian financial services ecosystem specializing in digital banking and payments. The company provides a comprehensive platform for over 42 million quarterly active consumers, offering solutions ranging from peer-to-peer payments and digital wallets to credit cards, insurance, and investment products. Additionally, PicPay serves over 800,000 active small and medium-sized businesses with acquiring and banking services.

The company plans to list on the NASDAQ on January 29, 2026, planning to offer 22.86 million Class A shares at a price range of $16.00 to $19.00. This IPO aims to raise approximately $400 million at the midpoint, valuing the company at a market capitalization of roughly $2.3 billion. The offering is managed by a syndicate including Citigroup, BofA Securities, and Mizuho.

Ethos Technologies

Ethos Technologies (Ticker: LIFE US) is a United States-based insurance technology company specializing in “the modernization of the life insurance industry”. Headquartered in Austin, Texas, Ethos operates a "three-sided" technology platform that connects consumers, insurance agents, and carriers. The company leverages machine learning and data science to expedite the application process, aiming to eliminate traditional barriers such as medical exams. Ethos plans to list on the NASDAQ exchange on January 29, 2026, following a pricing scheduled for January 28.

The company plans to offer approximately 10.53 million shares at a marketed price range of $18.00 to $20.00 per share, targeting a total offer size of approximately $200 million USD. The offering is reportedly structured with a 49% primary component, implying that just under half of the shares are being sold by the company itself, with the remainder sold by existing shareholders. Previously valued at $2.7 billion in a 2021 private funding round, Ethos functions as a technology enabler rather than a direct insurer, providing underwriting and distribution services for third-party carriers. The IPO is managed by joint bookrunners J.P. Morgan and Goldman Sachs.

York Space Systems

York Space Systems (Ticker: YSS US) is a U.S.-based space and defense prime specializing in proprietary satellite hardware and software for national security, government, and commercial customers. Headquartered in Denver, Colorado, the company provides low-cost satellite platforms and comprehensive solutions designed to address complex mission requirements across the space ecosystem. York Space Systems plans to list on the NYSE on January 29, 2026, following pricing scheduled for January 28.

The company intends to offer 16,000,000 shares (100% primary) at a price range of $30.00 to $34.00 per share. Through this offering, York Space Systems aims to raise approximately $512 million at the midpoint, with an upper limit of $544 million USD. At the top of this range, the company reportedly targets a valuation of up to $4.25 billion USD. Controlled by private equity firm AE Industrial Partners since a majority stake sale in 2022, the company is capitalizing on increased U.S. government demand for private space capabilities. The IPO is being managed by bookrunners including Goldman Sachs, Jefferies, and Wells Fargo.

Busy Ming

Busy Ming Group Co., Ltd. (Ticker: 1768 HK) is a Chinese company specializing in the snack and beverage retail sector. Operating under a "value retail model," the company manages a vast network of over 19,500 stores across China, employing a dual-brand strategy with its "Busy for You" and "Super Ming" outlets to offer affordable, high-turnover products. Busy Ming plans to list on the Hong Kong Stock Exchange on January 28, 2026, offering 14.10 million shares at a marketed price range of HKD 229.60 to HKD 236.60 per share.

Through this offering, the company aims to raise approximately HKD 3.34 billion (USD 427.8 million). At the proposed pricing, Busy Ming targets a market capitalization of roughly USD 6.4 billion. The IPO is managed by joint sponsors Goldman Sachs (Asia) and Huatai Financial Holdings, with Deutsche Bank and others acting as underwriters. The listing has reportedly attracted significant backing from cornerstone investors, including Fidelity, Tencent Holdings and Temasek. Recognized as a market leader by GMV in its segment, the company generates a majority of its revenue through sales to its extensive franchise network.

EquipmentShare.com

EquipmentShare.com, Inc. (Ticker: EQPT US) is a U.S. company specializing in equipment rental and construction technology. Headquartered in Missouri and incorporated in Texas, the firm operates as a major provider of modern, connected machinery with a network of 373 locations across 45 states. EquipmentShare.com manages a diverse fleet through its proprietary T3 platform, which reportedly provides real-time visibility into equipment efficiency and customer utilization, a feature that distinguishes it from traditional rental competitors.

The company plans to list on the NASDAQ on January 23, 2026. The offering consists of 30.5 million shares of Class A common stock with a price range of $23.50 to $25.50 per share. At the $24.50 mid-point, the IPO offer size is approximately $747.25 million (USD 747.25 million). Based on company filings, the estimated market capitalization at this price level is approximately $6.16 billion.

Czechoslovak Group

Czechoslovak Group (Ticker: CSG NA) is a Czech-based defence and industrial conglomerate specializing in the production of heavy ground equipment, radars, and large-calibre ammunition. Operating as a leading supplier to NATO partners and Ukraine, the company plans to list on Euronext Amsterdam on January 23, 2026. CSG intends to offer a 15.2% stake at €25.00 per share, raising €3.8 billion ($4.44 billion).

At this pricing, the company targets a market capitalization of approximately $29.19 billion (€25 billion). The offering is reportedly the largest ever in the defence sector. The majority of proceeds will go to selling shareholder and owner Michal Strnad, while the company expects to raise €750 million in new capital to be used for general corporate purposes and potential future acquisitions. Cornerstone investors include BlackRock and the Qatar Investment Authority, with the accelerated bookbuild managed by BNP Paribas and J.P. Morgan.

Longcheer

Shanghai Longcheer Technology Co., Ltd. (Ticker: 9611 HK) is a China-based company that focuses on the development and production of smartphones, tablets, and artificial intelligence internet of things (AIoT) products for global brands such as Xiaomi, Samsung and Lenovo. The company is currently listed on the Shanghai Stock Exchange under the ticker 603341 C.

Longcheer plans to list on the Hong Kong Stock Exchange on January 22, 2026, offering 52.26 million H shares. At an expected price of HKD 31.00 per share, the offering size is approximately HKD 1.62 billion (USD 207.75 million). Reportedly, the net proceeds are intended for expanding domestic and international production capacity, increasing investment in research and development, supporting marketing and customer expansion, and funding strategic acquisitions and working capital. The offering is managed by sponsors including Citigroup Global Markets Asia Ltd., Haitong International Capital Ltd., and Guotai Junan Capital Ltd.

BitGo

Bitgo Holdings, Inc. (Ticker: BTGO US) is a Cayman Islands-incorporated company specializing in digital asset custody, lending, and infrastructure services. Operating primarily out of the United States, Bitgo Holdings provides a technology platform that enables institutional clients to secure, manage, and create digital assets. The company serves over 4,600 clients globally, including financial institutions and government agencies, and reportedly managed approximately $90.3 billion in assets as of June 2025.

Bitgo Holdings plans to list on January 22, 2026. The company is planning to offer 11.82 million Class A shares at an expected price range of $15.00 to $17.00. This offering aims to raise approximately $200.97 million (USD). Based on the pricing terms, the company is targeting a market valuation of up to $1.96 billion (USD). The offering is led by Goldman Sachs & Co, with participation from Citigroup and Deutsche Bank. This move follows the company’s pivot to profitability and its recent approval to operate as a federally chartered national trust bank.

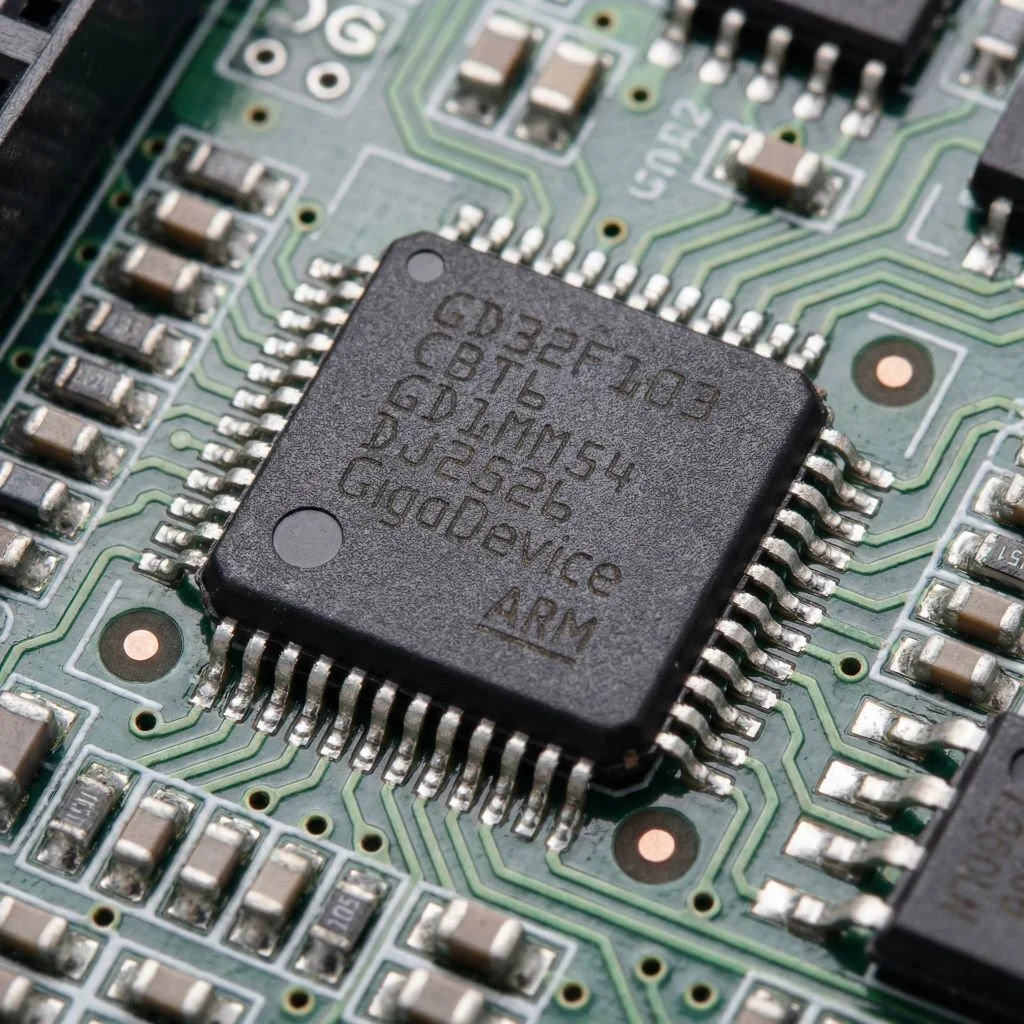

GigaDevice Semiconductor

GigaDevice Semiconductor Inc. (Ticker: 3986 HK) is a leading China-based fabless integrated circuit (IC) design house specializing in a diverse range of memory, ARM/RISC-V microcontroller (MCU), and sensor solutions. The company operates a "Sense, Memory, Compute, Control and Connectivity" ecosystem, providing Flash memory (NOR and SLC NAND), niche DRAM, analog chips, and fingerprint sensors. These products are utilized across various sectors, including automotive, industrial automation, energy storage, and consumer electronics. According to Frost & Sullivan, GigaDevice held significant market positions in 2024, ranking second globally in NOR Flash with an 18.5% market share and eighth globally in the MCU market.

GigaDevice plans to list on the Hong Kong Exchange on January 13, 2026. The company intends to offer approximately 28.92 million shares within a price range of HKD 132.00 to HKD 162.00 per share. This offering aims to raise up to HKD 4.68 billion (approximately USD 601.75 million). At the upper end of the price range, the company's implied market capitalization would be approximately HKD 112.88 billion (approx. USD 14.5 billion). Reportedly, the company plans to allocate the IPO proceeds toward research and development, product capacity expansion, brand promotion, and strategic acquisitions. The listing is sponsored by CICC and Huatai Financial Holdings.

HX Coldchain

Hongxing Coldchain (Hunan) Co., Ltd. (Ticker: 1641 HK) is a Chinese logistics services provider specializing in integrated frozen food storage and space leasing. Headquartered in Changsha, Hunan province, the company operates a business model that connects wholesalers and retailers by combining cold storage facilities with trading space leasing. According to the CIC Report cited in its filings, the company was the largest frozen food storage service provider in Central China and the leading provider of frozen food space leasing services in Hunan province by revenue in 2024. Its facilities in Changsha offer a designed storage capacity exceeding one million cubic meters.

Hongxing Coldchain plans to list on the Hong Kong Exchange on January 13, 2026. The company is offering approximately 23.26 million H-shares at a fixed price of HKD 12.26 per share. This IPO is expected to raise HKD 285.20 million (USD 36.64 million), implying a market capitalization of approximately USD 154.76 million. Reportedly, the company plans to use the proceeds for R&D and product capacity expansion, brand promotion, business development, working capital, and strategic acquisitions. The offering is sponsored by ABCI Capital and CCB International Capital.

Omnivision

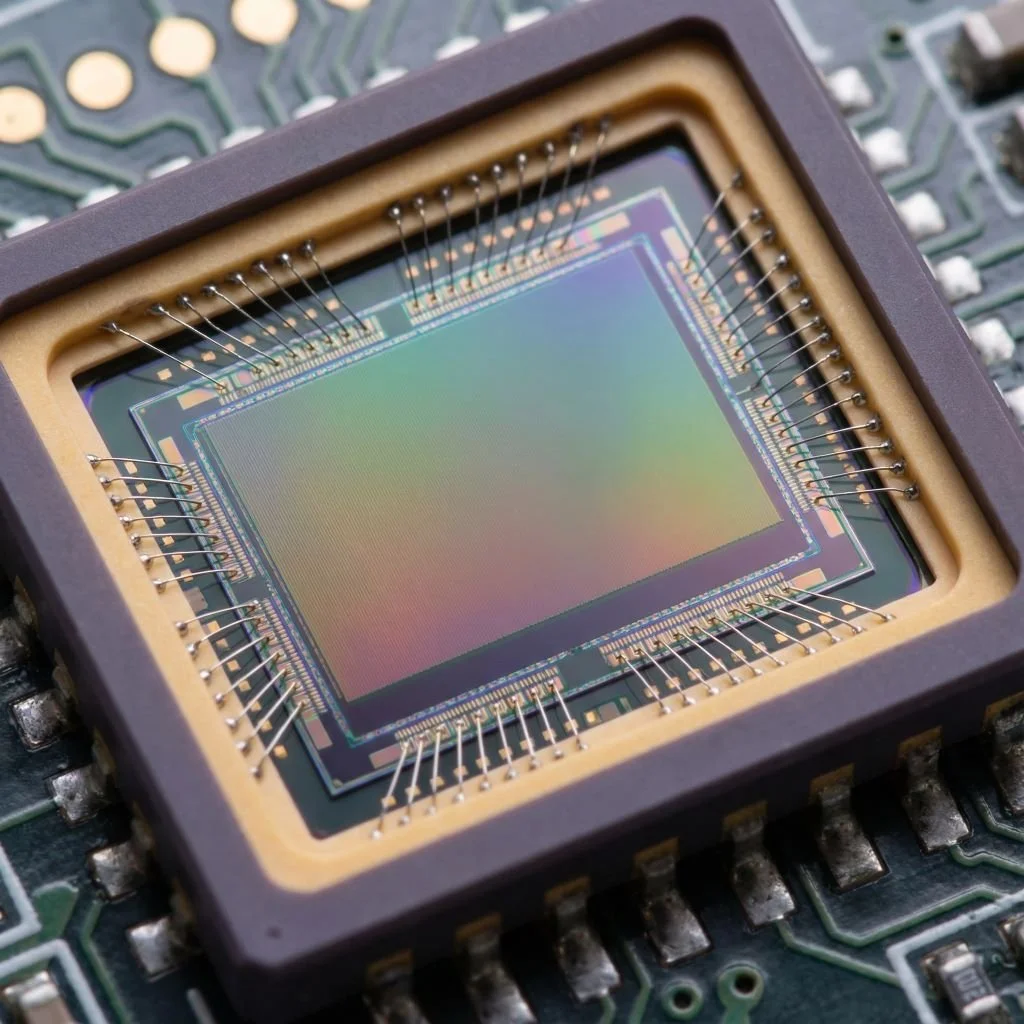

OmniVision Integrated Circuits Group Inc (Ticker: 501 HK) is a China-based global fabless semiconductor design company specializing in CMOS image sensors (CIS), display solutions, and analog integrated circuits. According to Frost & Sullivan, the company is the third-largest digital image sensor provider globally by revenue, holding a 13.7% market share. Its portfolio serves diverse verticals including smartphones, automotive electronics, medical devices, and emerging markets like Edge AI. The company employs a fabless model, focusing on R&D and design while collaborating with third-party foundries for manufacturing.

OmniVision plans to list on the Hong Kong Exchange on January 12, 2026. The company intends to offer 45.80 million shares, targeting a raise of approximately HKD 4.80 billion (USD 616.59 million) at an expected price of HKD 104.80 per share. Upon listing, the company is expected to have a market capitalization of approximately HKD 176 billion. Reportedly, the company plans to use the IPO proceeds for research and development, product capacity expansion, brand promotion, and strategic acquisitions. The offering is sponsored by CICC, UBS, GF Capital, and Ping An of China Capital.

Aktis Oncology

Aktis Oncology, Inc. (Ticker: AKTS US) is a U.S. clinical-stage biotechnology company developing a proprietary miniprotein radioconjugate platform for solid tumors. The company engineers proteins designed to deliver alpha-emitting Actinium-225 to validated targets, optimizing for deep tumor penetration and rapid systemic clearance to minimize toxicity. Its lead candidate, [225Ac]Ac-AKY-1189, targets Nectin-4 and is currently in a Phase 1b trial.

Aktis plans to list on the NASDAQ on January 9, 2026. Offering 17.7 million shares at $16.00–$18.00, the IPO aims to raise approximately $300 million at a ~$900 million valuation after upsizing the offer follwoing a $100 million cornerstone investment by Eli Lilly.

J.P. Morgan, BofA Securities, Leerink Partners, and TD Cowen are the underwriters. Proceeds will reportedly fund the lead program's clinical advancement and the progression of a second candidate targeting B7-H3 into trials.

MiniMax

Minimax Group Inc (Ticker: 100 HK) is a Shanghai-based company specializing in information technology services, specifically focusing on Artificial Intelligence (AI) foundation model research and AI-native application development. The company develops multi-modal models capable of processing text, video, and audio, such as MiniMax-M2 and Hailuo-02, which power consumer products like Talkie and Xingye.

Minimax plans to list on the Hong Kong Exchange on January 9, 2026, planning to offer approximately 25.39 million shares at a price range of HKD 151.00 to HKD 165.00 per share. This IPO is expected to raise approximately HKD 4.19 billion (USD 538.19 million). According to the prospectus, Minimax plans to use the majority of the IPO proceeds (90%) for R&D and product capacity expansion, with the remaining 10% allocated to working capital and strategic acquisitions. The offering is managed by a syndicate including China International Capital Corporation, UBS, Goldman Sachs (Asia), Morgan Stanley, and others. The company, which utilizes a "Mixture-of-Experts" architecture for its models, reportedly serves over 200 million users globally across more than 200 countries and regions.

Jinxun Resources

Yunnan Jinxun Resources Co., Ltd. (Ticker: 3636 HK) is a Chinese company specializing in the processing, smelting, and trading of non-ferrous metals, with a primary focus on producing high-quality copper cathodes. Strategically operating in Africa, the company manages copper smelters and flotation plants in the DR Congo and Zambia. According to Frost & Sullivan, the firm ranked fifth among PRC copper cathode producers in these regions by volume in 2024. The company also conducts non-ferrous metal trading via subsidiaries in Singapore and China and is reportedly expanding into cobalt-related production to serve the new energy materials sector.

Yunnan Jinxun Resources plans to list on the Hong Kong Exchange on January 9, 2026. The company is offering approximately 36.77 million H-shares at a fixed price of HKD 30.00 per share. The offering aims to raise HKD 1.10 billion (USD 141.69 million), implying a market capitalization of approximately USD 566.75 million. Reportedly, the company plans to use the majority of the IPO proceeds (80%) for brand promotion and business development, with the remaining funds allocated to working capital, strategic acquisitions, and debt repayment. The offering is sponsored by Huatai Financial Holdings and underwritten by a syndicate including ABCI Capital, BOCI Asia, and CITIC Securities.

Ribo Life

Suzhou Ribo Life Science Co., Ltd. (Ticker: 6938 HK) is a Chinese biopharmaceutical company specializing in the research and development of oligonucleotide therapeutics, with a primary focus on small interfering RNA (siRNA) drugs. Founded in 2007, the company develops innovative treatments for cardiovascular, metabolic, renal, and liver diseases. Its core product, RBD4059, is an FXI-targeting siRNA drug designed to treat thrombotic diseases and is currently in Phase 2 clinical trials.

Ribo Life plans to list on the Hong Kong Exchange on January 9, 2026. The company is offering approximately 27.49 million H-shares at a fixed price of HKD 57.97 per share. This IPO is expected to raise HKD 1.59 billion (USD 204.69 million), valuing the company at approximately USD 1.20 billion. According to the prospectus, Ribo Life plans to allocate the vast majority of the IPO proceeds toward R&D and product capacity expansion for its pipeline assets, with the remaining funds set aside for working capital and strategic acquisitions. The offering is joint-sponsored by CICC and Citigroup.

Iluvatar CoreX Semi

Shanghai Iluvatar CoreX Semi (Ticker: 9903 HK, also trading as Shanghai Tianshu Zhixin Semiconductor Co. Ltd.) is a Chinese semiconductor company specializing in general-purpose graphics processing units (GPGPUs) and AI computing solutions. The company plans to list on the Hong Kong Stock Exchange on January 8, 2026. The company is offering 25.43 million shares at HKD 144.60 per share, aiming to raise HKD 3.68 billion (approximately USD 472.5 million). This offering values the company at approximately HKD 36.77 billion (USD 4.73 billion).

According to filings, the company plans to allocate a significant portion of the IPO proceeds to research and development and product capacity expansion, with the remaining 20% split between brand promotion and working capital. Iluvatar CoreX focuses on a "software-hardware co-design" philosophy and reportedly is the first Chinese chip designer to mass-produce both training and inference GPGPU chips using 7nm process technology. Its product line includes cloud training chips and driver software compatible with mainstream GPGPU ecosystems. The IPO is sponsored by Huatai Financial Holdings, with Bowlea Securities and CMB International among the underwriters.

Edge Medical

Shenzhen Edge Medical Co (Ticker: 2675 HK) is a Chinese medical equipment company specializing in advanced surgical robotics. The company, formally Shenzhen Edge Medical Co., Ltd., plans to list on the Hong Kong Stock Exchange on January 8, 2026. The offering consists of 27.72 million H-shares at a price of HKD 43.24 per share, aiming to raise HKD 1.20 billion (approximately USD 154 million). This implies a market capitalization of approximately HKD 16.77 billion (USD 2.15 billion).

The company intends to use the IPO proceeds for research and development (R&D), product capacity expansion, brand promotion, business development, working capital, and strategic acquisitions. Founded in 2017, Shenzhen Edge Medical designs and manufactures robot-assisted devices for minimally invasive surgery (MIS). Its portfolio includes the "Edge Multi-Port" and "Edge Single-Port" Endoscopic Surgical Robots, both of which are core products approved by China's NMPA and have received CE Marking in the EU. The company claims to be the first in China to receive registration approvals for multi-port, single-port, and natural orifice surgical robots. In 2024, it reportedly ranked first among domestic manufacturers in sales of multi-port units. The offering is sponsored by Morgan Stanley and GF Capital.

Zhipu

Beijing Zhipu Huazhang Technology Co. Ltd. (Ticker: 2513 HK) is a Chinese technology company specializing in artificial intelligence and general-purpose large language models (LLMs). The company plans to list on the Hong Kong Stock Exchange on January 8, 2026, planning to offer 37.42 million H-shares at a price of HKD 116.20 per share. The company aims to raise HKD 4.35 billion (approximately USD 559 million), resulting in a valuation of approximately USD 6.57 billion.

The firm reportedly plans to use the IPO proceeds primarily for research and development and product capacity, with the remainder allocated to brand promotion, business development, and general working capital. The company is a leading independent AI developer in China, known for its proprietary GLM framework and "Z.AI" models. Its latest iteration, GLM-4.7, reportedly ranks 6th on the LLM Leaderboard, positioning it alongside major global competitors like ChatGPT and Gemini. According to filings, the company generated RMB 312.4 million in revenue in 2024, reflecting a CAGR of over 130% since 2022. The offering is sponsored by China International Capital Corporation.

Biren Technology

Shanghai Biren Technology Co., Ltd. (Ticker: 6082 HK) is a Chinese technology company specializing in the development of general-purpose graphics processing units (GPGPU) and artificial intelligence computing solutions. The company plans to list on the Hong Kong Stock Exchange on January 2, 2026. Biren Technology is offering approximately 247.7 million shares at an expected price range of HKD 17.00 to HKD 19.60 per share. The IPO aims to raise HKD 4.85 billion ($624.03 million). At the proposed pricing, the company anticipates a market capitalization between HKD 40.1 billion and HKD 46.2 billion (approximately $5.16 billion to $5.95 billion).

Biren Technology focuses on providing foundational computing power for AI through its self-developed GPGPU architecture and the proprietary BIRENSUPA software platform. Its products support the training and inference of large language models (LLMs) and are deployed across data centers, telecommunications, and financial technology sectors. According to filing documents, the company reportedly plans to allocate 85% of the IPO proceeds toward research and development and expanding product capacity, with the remainder designated for working capital, strategic acquisitions, and brand promotion. The offering is managed by BOCI Asia, CICC, CLSA, and others.

USAS Building System

USAS Building System (Shanghai) Co., Ltd. (Ticker: 2671 HK) is a Chinese integrated prefabricated steel structure building (PS building) subcontracting service provider specializing in the industrial sector. The company plans to list on the HKEX on December 30, 2025, offering 24.6 million shares at an expected price range of HKD 7.10 to HKD 9.16. This offering aims to raise approximately HKD 225.34 million (equivalent to roughly USD 28.96 million). USAS Building is a leading player in its field, reportedly ranking third in China’s industrial PS building market by revenue in 2024 with a 3.5% market share.

The company has an estimated market capitalization at the time of the offer ranging from approximately USD 110 million to USD 142 million (HKD 856 million to HKD 1.1 billion). According to its prospectus, USAS Building plans to use the IPO proceeds for research and development and increasing production capacity, brand promotion and business development, and for working capital and potential strategic acquisitions. The company provides a full suite of services including project design, procurement, manufacturing, and installation. The offering is sponsored by Shenwan Hongyuan Capital (H.K.) Limited, with ABCI Securities and BOCI Asia among the joint underwriters.

OneRobotics

OneRobotics Shenzhen Co Ltd (Ticker: 6600 HK) is a China-based company specializing in home robotic systems, smart automation devices and sport robotics (e.g. tennis robot Acemate). The company develops execution-enhanced robots, including humanoid and dexterous hand-mimic robots under the SwitchBot brand, serving markets across Japan, Europe, and North America. OneRobotics plans to list on the Hong Kong Stock Exchange on December 30, 2025.

The company is offering 22.22 million shares at a price range of HKD 63.00 to HKD 81.00 per share. The offer aims to raise up to HKD 1.80 billion (approximately USD 231 million). At the proposed pricing, the company reportedly seeks a market capitalization between USD 1.8 billion and USD 2.3 billion. According to regulatory filings, OneRobotics plans to use the majority of the IPO proceeds for research and development and product capacity expansion. The remaining funds are allocated for brand promotion, working capital, and debt repayment. The deal is sponsored by Huatai Financial Holdings and Guotai Junan Capital, with BOCI Asia and others acting as underwriters.

51WORLD

Beijing 51WORLD Digital Twin Technology Co., Ltd. (Ticker: 6651 HK) is a Chinese technology company specializing in digital twin infrastructure and software. The company integrates proprietary 3D graphics, physical simulation, and artificial intelligence to generate accurate virtual replicas of real-world entities, serving sectors such as urban planning, automotive, and energy. Its core business lines include the enterprise platform 51Aes, the autonomous driving simulation platform 51Sim, and the consumer-facing 51Earth initiative. 51World plans to list on the Hong Kong Stock Exchange on December 30, 2025.

The company plans to offer approximately 23.98 million shares at a price of HKD 30.50 per share. Through this offering, 51World aims to raise approximately HKD 731 million (USD 93.98 million). According to the prospectus, the company reportedly ranked first in revenue within China's digital twin industry in 2024. 51World plans to use the IPO proceeds to enhance its research and development capabilities, expand product capacity, and fund brand promotion and strategic acquisitions. The listing is jointly sponsored by China International Capital Corporation (CICC) and Huatai Financial Holdings, with distribution supported by a syndicate including ABCI Securities and BOCI Asia.

Insilico Medicine

Insilico Medicine Cayman TopCo (Ticker: 3696 HK) is a Hong Kong-based biotechnology company specializing in artificial intelligence-driven drug discovery. The company utilizes its proprietary generative AI platform, Pharma.AI, to accelerate the development of pharmaceuticals, reportedly generating over 20 clinical or IND-enabling assets to date. Insilico Medicine plans to list on the Hong Kong Stock Exchange on December 30, 2025, planning to offer approximately 94.69 million shares at HKD 24.05 per share.

Through this offering, the company is raising HKD 2.28 billion (approximately USD 293 million). At this listing price, the company reportedly commands a market capitalization of approximately USD 1.72 billion. According to filings, Insilico Medicine plans to use the IPO proceeds primarily (83%) for research and development and expanding product capacity, with the remainder allocated to brand promotion, business development, and general working capital. The offering is sponsored by CICC, Morgan Stanley, and GF Capital, with BNP Paribas and BOCI Asia serving as joint underwriters.

Forest Cabin

Shanghai Forest Cabin Cosmetics Group Co., Ltd. (Ticker: 2657 HK) is a Chinese premium skincare company specializing in anti-wrinkle and firming products rooted in camellia-based ingredients. Forest Cabin plans to list on the HKEX on December 30, 2025, offering 13,966,450 shares at a price of HKD 77.77. This offering aims to raise approximately HKD 1.086 billion (equivalent to roughly USD 139.59 million). According to the prospectus, the company is a domestic leader in the "oil-based skincare" market, with its flagship Camellia Essence Oil ranking first in China by retail sales among facial essence oils for eleven consecutive years.

The company reportedly plans to use the IPO proceeds for brand promotion and business development (40%), research and development and production capacity (30%), working capital and strategic acquisitions (15%), and other general corporate purposes (15%). Forest Cabin ranked as the only domestic brand among the top 15 premium skincare labels in China by retail sales in 2024. The listing is sponsored by Huatai Financial Holdings and CITIC Securities. Founded in 2003 with its primary research journey beginning in 2012, the company maintains a dominant position in China’s high-end beauty sector, reporting revenue of RMB 1,197.8 million for the full year 2024.

Xunce Technology

Shenzhen Xunce Technology Co., Ltd. (Ticker: 3317 HK) is a Chinese provider of real-time data infrastructure and analytics solutions, primarily serving the asset management industry and various diversified sectors. The company plans to list on the HKEX on December 30, 2025, following a subscription period from December 18 to December 23. Xunce Technology is offering 22.5 million shares at a price range of HKD 48.00 to HKD 55.00, aiming to raise approximately HKD 1.24 billion (equivalent to roughly USD 148.91 million). Based on 2024 revenue, the company reportedly ranks fourth in China’s real-time data infrastructure and analytics market and first within the asset management sub-segment.

The company has an estimated market capitalization ranging from approximately USD 1.98 billion to USD 2.27 billion (HKD 15.48 billion to HKD 17.74 billion). According to its prospectus, Xunce Technology plans to use the IPO proceeds for the further development of existing solutions and new technology capabilities, deepening penetration into diversified industries, enhancing marketing capabilities, and general working capital. The company's platform provides unified data processing within milliseconds to seconds for high-stakes decision-making. Guotai Junan Capital Limited is the sole sponsor for the offering, and major investors reportedly include Tencent and KKR.

SemiFive

SemiFive Inc. (Ticker: 490470 KS) is a South Korea-based semiconductor design solution provider specializing in custom System-on-Chip (SoC) platforms and ASIC design services. The company plans to list on the KOSDAQ exchange on December 29, 2025. SemiFive intends to offer 5.4 million new shares within a target price range of KRW 21,000 to KRW 24,000 per share. At the lower end of this guidance, the IPO is expected to raise KRW 113.4 billion (approximately $77.1 million USD).

Founded in 2019, SemiFive operates as a Design Solution Partner (DSP) within the Samsung Advanced Foundry Ecosystem (SAFE), acting as a bridge between fabless companies and Samsung’s foundry manufacturing. The company offers turnkey services ranging from architecture planning to packaging, with expertise in advanced process nodes including 14nm, 8nm, and 5nm. Strategic backers include RISC-V computing company SiFive, Inc., which holds an 18% stake. Samsung Securities is serving as the lead underwriter for the transaction. While the company generated reported revenues of KRW 111.8 billion, it remains loss-making, and proceeds will reportedly support continued R&D and ecosystem expansion.

LivsMed

LivsMed Inc. (Ticker: 491000 KS) is a South Korean medical device manufacturer specializing in the development of advanced tools for minimally invasive surgery. The company plans to list on the KOSDAQ exchange on December 24, 2025. LivsMed intends to offer 2.47 million new shares within a target price range of KRW 44,000 to KRW 55,000 per share. At the lower end of this range, the offering aims to raise approximately KRW 108.7 billion (roughly $73.9 million USD).

LivsMed focuses on handheld multi-joint laparoscopic surgical instruments, marketed primarily under the brand ArtiSential. Unlike traditional straight instruments, these devices are designed to replicate the articulation of the human wrist, providing surgeons with 90-degree dexterity in all directions within narrow surgical cavities. The company is also commercializing the ArtiSeal vascular sealer and developing the LivsCam 3D4K camera system. Samsung Securities and Mirae Asset Securities are acting as the lead underwriters for the deal.

HanX Biopharmaceuticals

HanX Biopharmaceuticals Inc. (Ticker: 3378 HK) is a Chinese biotechnology company specializing in structural biology, translational medicine, and clinical development. The company is focused on creating next-generation immunotherapeutics for oncology and autoimmune diseases. Its pipeline includes one core product, HX009, a bifunctional anti-PD-1 antibody SIRP fusion protein currently in clinical trials for various cancers, as well as two key clinical-stage products, HX301 and HX044. HanX plans to list on the Hong Kong Stock Exchange on December 23, 2025.

The company aims to offer approximately 18.32 million shares at a price range of HKD 28.00 to HKD 32.00, targeting a raise of up to HKD 586.27 million (approximately USD 75.34 million). This valuation implies a market capitalization between HKD 3.81 billion and HKD 4.36 billion (roughly USD 490 million to USD 560 million). Reportedly, HanX intends to direct the vast majority of proceeds (85%) toward R&D and product capacity, with the remainder allocated to working capital and brand promotion. The IPO is sponsored by ICBC International, with a syndicate of underwriters including ABCI, CCB International, and others.

QingSong Health

QingSong Health Corp (Ticker: 2661 HK) is a China-based company operating two core business lines: Qingsong Insurance, an internet insurance sales platform leveraging AI and big data to offer personalized products in collaboration with major insurers like PICC and Ping An; and Qingsong Healthcare, which provides comprehensive solutions including early disease screening, customized health packages, and medical research assistance. The company is scheduled to list on the Hong Kong Stock Exchange on December 23, 2025.

The company plans to offer 26.54 million shares at a fixed price of HKD 22.68, aiming to raise HKD 601.93 million (approximately USD 77.35 million). This pricing implies a market capitalization of roughly USD 601.45 million. Reportedly, QingSong Health intends to allocate 50% of the IPO proceeds to brand promotion and business development, 40% to R&D and product capacity expansion, and the remaining 10% to working capital and strategic acquisitions. The offering is sponsored by CICC and China Merchants Securities.

Nuobikan AI Tech

Nuobikan Artificial Intelligence Technology (Chengdu) Co., Ltd. (Ticker: 2635 HK) is a Chinese company specializing in industrial AI and digital twin technologies. The company provides integrated software and hardware solutions for transportation, energy, and urban management, serving as a prominent provider of AI-enabled traction power supply inspection systems for rail transit in China. Nuobikan plans to list on the Hong Kong Stock Exchange on December 23, 2025.

The company intends to offer approximately 3.79 million shares priced between HKD 80.00 and HKD 106.00, aiming to raise up to HKD 401.38 million (USD 51.58 million). This pricing implies a market capitalization ranging from approximately USD 389 million to USD 515 million. Reportedly, Nuobikan plans to allocate 80% of the IPO proceeds to R&D and product capacity expansion, with the remaining funds designated for working capital and strategic acquisitions. The offering is sponsored by CICC, with underwriting support from Livermore Holdings and Patrons Securities.