Digital Grid

DIGITAL GRID Corporation (Ticker: 350A JP), a Japanese company, operates the Digital Grid Platform (DGP), a marketplace enabling companies to directly trade electricity and procure environmental attributes like renewable energy certificates. The company also provides aggregation services for distributed power sources and offers decarbonization-related consulting and learning services. DIGITAL GRID plans to list on the Tokyo Stock Exchange Growth Market on April 22, 2025. The offering consists of 1.827 million shares (a mix of new and existing) priced between JPY 4,400 and JPY 4,570, aiming to raise approximately USD 56.55 million (approx. JPY 8.48 billion). The estimated market capitalization at IPO is USD 183.64 million (approx. JPY 27.55 billion). Daiwa Securities is the lead underwriter.

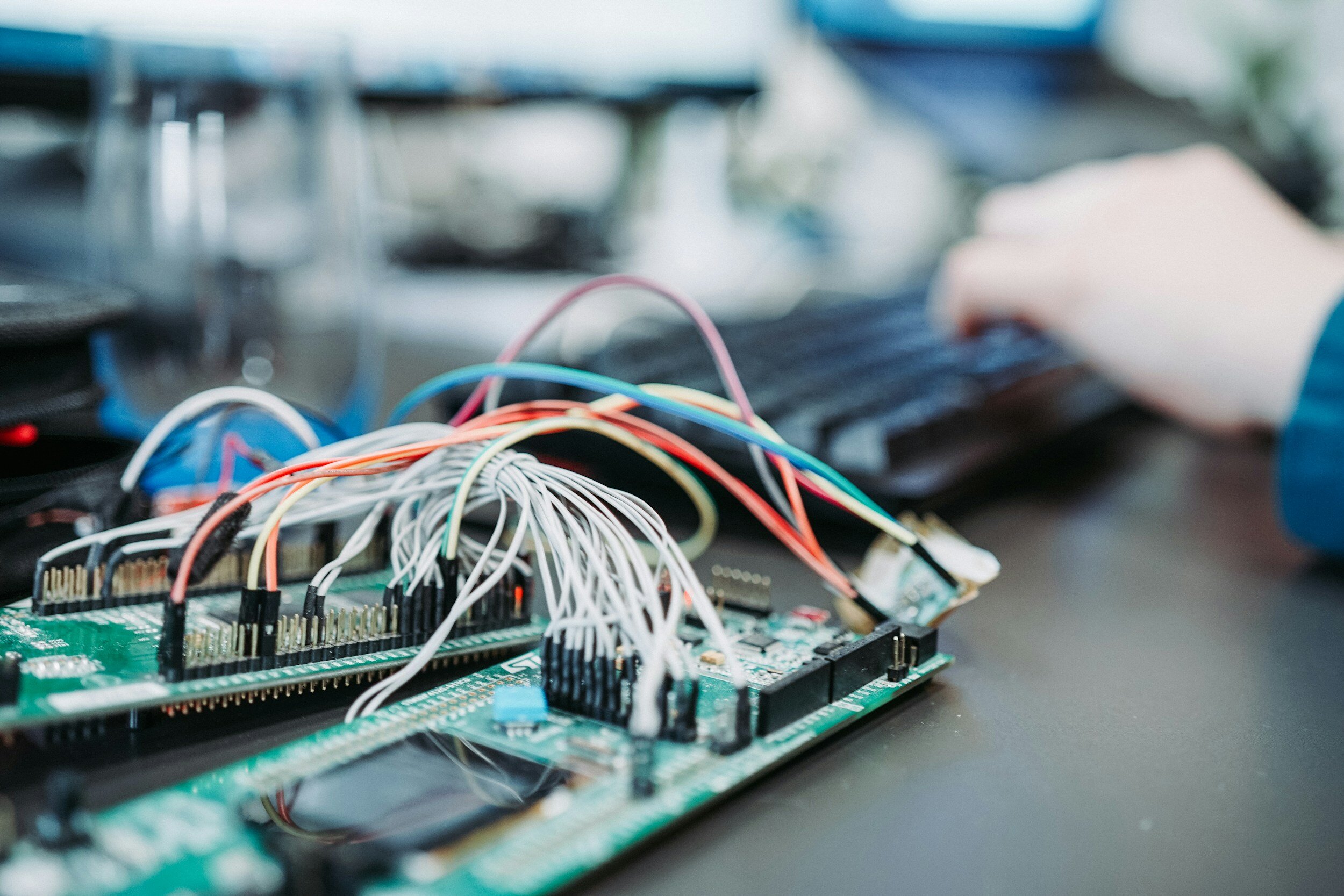

Process Technologies Group

Process Technologies Group, Inc. (Ticker: 339A JP), a Japanese company providing digital solutions and digital engineering services for major manufacturers, plans to list on the Tokyo Stock Exchange Growth Market on March 28, 2025. The IPO offering consists of 3,807,200 shares (707,200 primary and 3,100,000 secondary) with an indicative price range of ¥1,890 - ¥1,950 (USD 12.76 - 13.17). The offering aims to raise approximately USD 49.51 million. An overallotment option of 571,000 shares is available. The company was established in 2020. The lead underwriter is Nomura. Major shareholders, predominantly venture capital funds managed by JAFCO (JAFCO SV6), are the sellers in this offering. Proceeds from sale of new shares will go to company.

Dynamic Map Platform

Dynamic Map Platform Co., Ltd. (Ticker: 336A JP), a Japanese company specializing in high-precision 3D map data (HD maps) for autonomous driving and related location solutions, plans to list on the Tokyo Stock Exchange Growth Market on March 27, 2025. The IPO offering is for 6.16 million shares (4.81 million primary and 1.35 million secondary) with an indicative price range of ¥1,130-¥1,200 (USD 7.63 - 8.10). The upsized IPO aims to raise up to ¥7.4 billion (USD 50.3 million). An overallotment option of up to 924,000 primary shares exists. The company was incorporated in 2016. Key shareholders include INCJ and GeoTechnologies, which are the sellers in this offering, proceeds reportedly go to them. SMBC Nikko is the bookrunner. The Market Cap is USD 148.45 million.

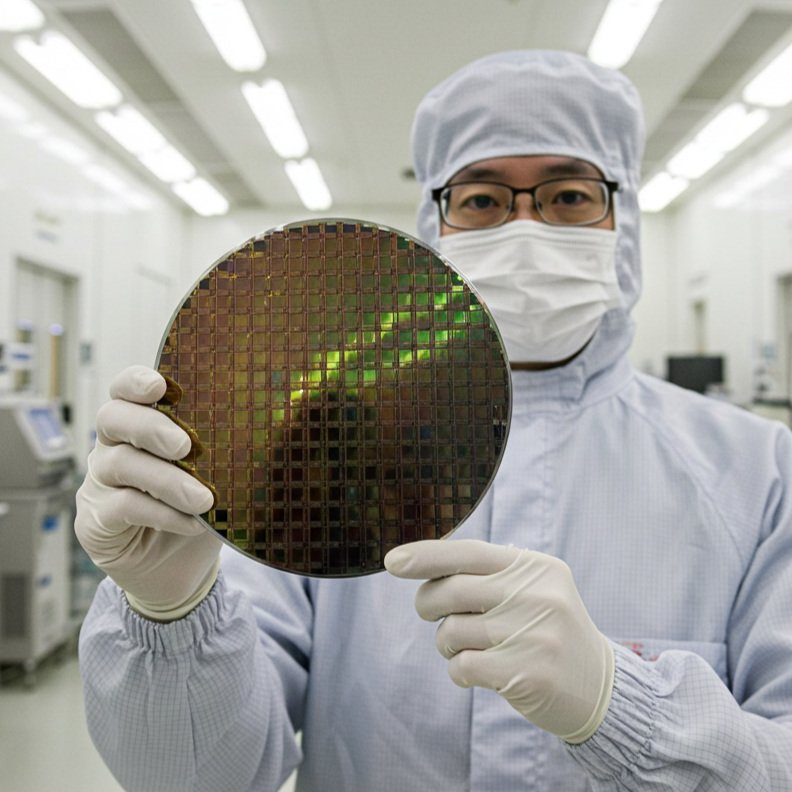

JX Advanced Metals

JX Advanced Metals Corporation (Ticker: 5016 JP), a Japanese company specializing in high-purity metals and compound semiconductor wafers for the microelectronics industry, plans to list on the Tokyo Stock Exchange on March 19. JX Advanced Metals, a subsidiary of Eneos Holdings, is offering 465,160,100 existing shares at an indicative price of ¥862 per share, aiming to raise approximately ¥400.9 billion (USD 3 billion).

The IPO proceeds will go to the parent company, Eneos Holdings, which reportedly plans to use the funds for shareholder returns and decarbonization investments. Joint global coordinators on the deal are Daiwa Securities Group, JPMorgan Chase & Co., Morgan Stanley and Mizuho Financial Group. This IPO is the largest in Japan since SoftBank Corp's 2018 listing.

Tential

TENTIAL Inc. (Ticker: 325A) is a Japanese company that operates the "TENTIAL" brand, focusing on casual clothing, sandals, socks, insoles, bedding and sleep accessories in the premium segment. The company says that it emphasizes a science-backed approach, incorporating athlete feedback and aiming for products with demonstrable functional benefits.

TENTIAL Inc. will list on February 28, 2025, on the Tokyo Stock Exchange's Growth Market. The firm selling shares at the price yet to be determined. The expected Market Capitalization at offer is $85.52 million. The total offer size is $35.78 million. The offering is managed by Nomura.

Synspective

Synspective Inc. (Ticker: 290A) is a space technology company specializing in the development and operation of small synthetic aperture radar (SAR) satellites. The company also provides SAR data and related solutions for advanced earth imaging.

Synspective will list on December 19 on the Tokyo Stock Exchange Growth Market. The firm is offering shares with a total offer size of approximately USD 66.97 million. The expected market capitalization at the offering is approximately USD 273.32 million. The offering is managed by Nomura.

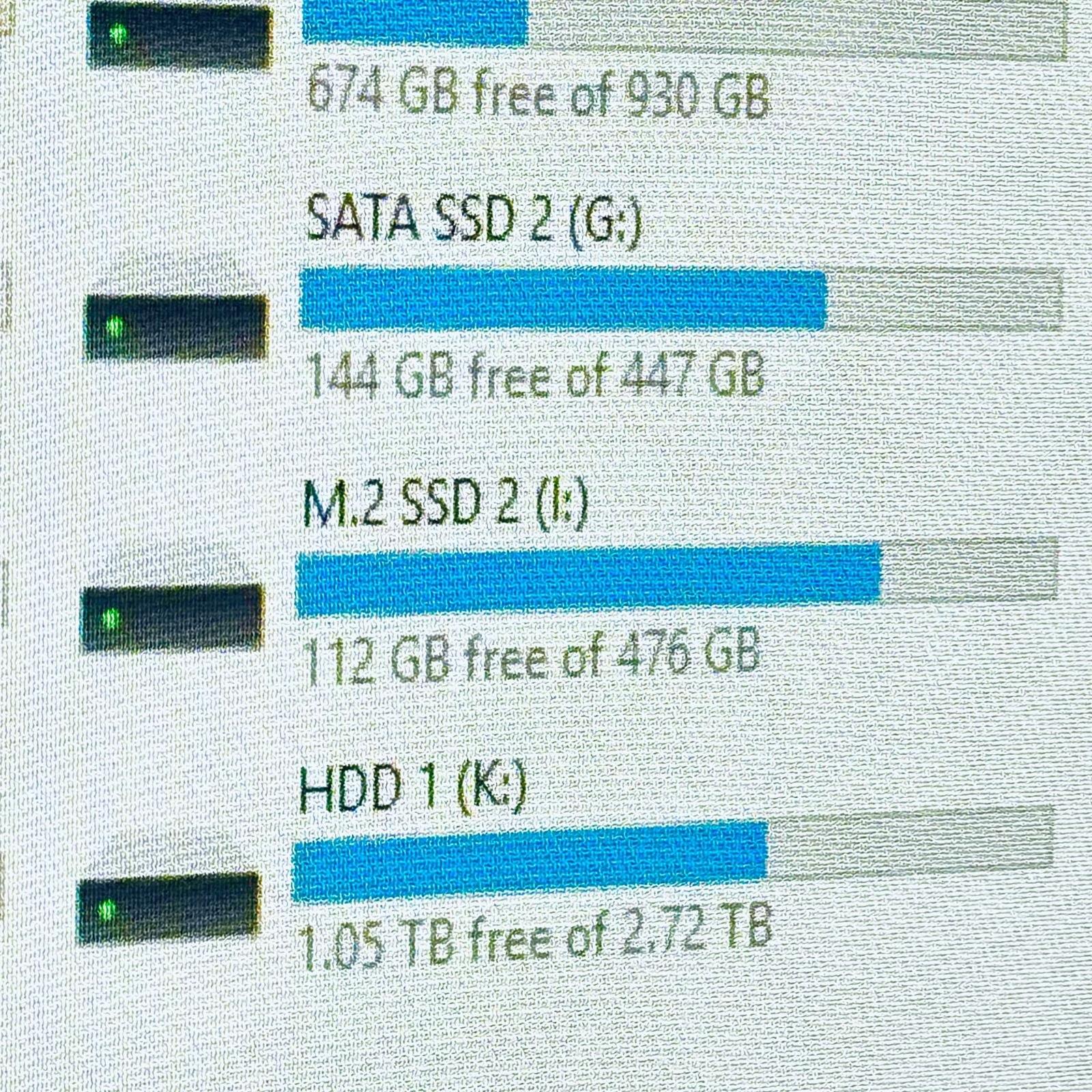

Kioxia

Kioxia Holdings Corporation (Ticker: 285A JP) is a technology company specializing in NAND flash memory and solid-state storage solutions for consumer electronics, data centers, and industrial applications. Kioxia will list on December 18 on the Tokyo Stock Exchange Prime Market.

The firm is offering shares with a total offer size of approximately USD 700 million. The expected market capitalization at the offering is approximately USD 5.04 billion. The offering is managed by Mitsubishi UFJ Morgan Stanley Securities Co., Ltd. and Nomura.

Kuroda Group

Kuroda Group Co., Ltd. (Ticker: 287A JP) is a manufacturing and trading company specializing in electric materials, electronic components, LCD printing plates, and automation equipment for the electronics and automotive industries. Founded in 1945, the company operates across four main business areas: manufacturing (direct materials and production goods) and trading (domestic and overseas). Kuroda Group will list on December 17, 2024, on the Standard Market. The company is offering shares to raise $54.44 million, with an expected market capitalization of $208.69 million. The offering is managed by SMBC Nikko and Nomura.

Eucalia

Eucalia Inc. (Ticker: 286A.TK) is a healthcare services company based in Tokyo, Japan. Founded in 2005, the company focuses on transforming healthcare through a range of businesses, including management support for medical institutions and the operation and introduction of senior care facilities. Eucalia’s mission is to improve the quality of life for patients, caregivers, and healthcare professionals while stabilizing medical and nursing facility operations and advancing digital transformation in healthcare.

The company will list on December 12, 2024, on the Growth Market in Tokyo. The offering consists of 3,942,900 new shares and 6,368,000 existing shares, with an over-allotment option of 1,546,600 shares. The expected price range for the offering is ¥1,020–¥1,060 per share.

The anticipated market capitalization at the offer price is ¥34.02 billion (USD ~229.66 million), with a total offer size of ¥10.32 billion (USD ~69.57 million). SBI Securities Co., Ltd. is the lead underwriter for the IPO.

Globe-ing

Globe-ing Inc. (Ticker: 277A JP) is a consulting and software-as-a-service (SaaS) provider offering strategy consulting and cloud product solutions.

The company will list on November 29, 2024, on the Growth Market of the Tokyo Stock Exchange. The IPO consists of a total offer size of 26.91 million USD (JPY equivalent), with an expected market capitalization of 148.65 million USD (JPY equivalent). The offering is managed by Mitsubishi UFJ Morgan Stanley Securities Co., Ltd.

Garden

Garden Co., Ltd. (Ticker: 274A) is a Japanese company specializing in the operation of various restaurant chains. Its portfolio features popular brands such as "壱角家" (Ikkakuya), known for ramen, and "山下本気うどん" (Yamashita Honki Udon), focused on udon noodles. Other notable establishments include "肉寿司" (Niku Sushi), which offers meat-based sushi, and "鉄板王国 ステーキの王様" (Teppan Kingdom Steak no Osama), a teppanyaki and steak restaurant. The company actively engages in franchise development and has expanded its brand lineup through mergers and acquisitions (M&A).

Garden Co., Ltd. will list on November 22, 2024, on the Standard Market of the Tokyo Stock Exchange. The IPO aims to raise approximately $33.16 million, with an expected market capitalization of $103.63 million. The offering is managed by Tokai Tokyo.

Rigaku Corp.

Rigaku Corporation (Ticker: TBD) is a Japanese manufacturer of X-ray testing tools. The company, backed by Carlyle Group, will list on the Tokyo Stock Exchange on October 25, 2024. Rigaku is offering shares to raise up to 126.1 billion yen (USD 876 million), including an overallotment option.

The expected market capitalization at the time of the offering is 284.1 billion yen (USD 1.98 billion). Carlyle Group's shareholding in Rigaku will drop from 75.5% to 40.7% post-IPO. The offering is managed by Bank of America, JPMorgan, Morgan Stanley, and Nomura.

Tokyo Metro

Tokyo Metro Co., Ltd. (Ticker: TBD) is a Japanese railway operator that manages Tokyo's subway system. Tokyo Metro will list on the Tokyo Stock Exchange on October 23, 2024. The company is offering shares at an indicative price of 1,100 yen, aiming to raise 319.55 billion yen (USD 2.23 billion). The expected market capitalization at the time of the offering is 639.1 billion yen (USD 4.44 billion).

The central government and the Tokyo government, which together hold 100% of Tokyo Metro, plan to sell half of their shares. Proceeds from the sale will be used to repay reconstruction bonds from the 2011 earthquake. The offering is managed by Goldman Sachs, Mizuho, and Nomura.

Intermestic

Intermestic Inc. (Ticker: 262A.T) is a Japan-based company engaged in the manufacturing and sales of eyewear, lenses, and accessories, including imports. The company will list on the Tokyo Stock Exchange Prime Market on October 18, 2024.

Intermestic Inc. is offering 7.88 million new shares along with 2.84 million existing shares at ¥1,630 per share. The total offer size is ¥17.16 billion (approximately $116.09 million USD). The estimated post-IPO market capitalization is ¥49.88 billion (around $337.38 million USD). The IPO is managed by SMBC Nikko, with Nomura, Mizuho, and Rakuten Securities.

Nihon Suido Consultants

Nihon Suido Consultants Co., Ltd. (Ticker: 261A) is a construction consulting firm specializing in water infrastructure, with a focus on drinking and wastewater systems. The company will list on October 16, 2024, on the Standard market in Japan.

Nihon Suido Consultants is offering 5,245,300 shares, all of which are existing shares, at an offer price of ¥1,430 per share. The expected market capitalization at the time of the offering is ¥17.1 billion (USD 114.54 million). The total offer size is ¥7.5 billion (USD 50.63 million). The offering is managed by Nomura Securities.

Alt

alt Inc. (Ticker: 260A.T) is a communications company engaged in the research and development of digital clone P.A.I. technologies, including products like AI Gijiroku and other AI solutions. alt Inc. will list on October 11, 2024, on the Growth market in Japan.

The company is offering 9,000,000 shares, including 7,500,000 new shares and 1,500,000 existing shares, at an offer price of ¥540 per share. The expected market capitalization at the time of the offering is ¥14.9 billion (USD 94.21 million). The total offer size is ¥4.86 billion (USD 32.81 million). The offering is managed by Daiwa Securities.

Shimadaya Corporation

Shimadaya Corporation (Ticker: 250A) is a food products company specializing in the manufacturing and sale of noodles and related food products. The company is set to list on the Tokyo Stock Exchange Standard Market on October 1, 2024. Shimadaya is offering 2,280,700 existing shares at an offering price of ¥1,880 per share, with a total offer size of approximately ¥4.29 billion (about $29.82 million USD). For the fiscal year ending March 2024, Shimadaya reported consolidated revenue of ¥38.93 billion and a net profit of ¥2.52 billion. The offering is managed by Daiwa Securities.

ROXX

ROXX, Inc. (Ticker: 241A) is a communications company operating the "Z Career" job platform, which specializes in matching non-desk workers with employers, focusing on service industries and blue-collar jobs. ROXX, Inc. will list on September 25, 2024, on the Tokyo Stock Exchange Growth Market. The firm is offering 325,000 new shares and 2,598,100 existing shares at a price of ¥2,110 per share.

The offer size is ¥6.17 billion (USD 41.87 million). The expected market capitalization at offer is ¥15.35 billion (USD 104.11 million). The offering is managed by Mizuho, with additional support from Nomura, SBI Securities, Daiwa, and several other underwriters.

FIT EASY

FIT EASY Inc. (Ticker: 212A.TK) is a Japanese fitness company that operates amusement-style fitness gyms open 24 hours a day, all year round. The company provides various services, including advanced fitness machines, AI facial recognition security, and a wide range of additional amenities such as saunas, self-care rooms, virtual fitness studios, and co-working spaces.

FIT EASY will list its shares on July 23 in Japan. The firm plans to offer between 4,300,000 and 4,945,000 shares at an expected price range of ¥950 - ¥990. The expected proceeds from the IPO range between ¥4,085,000,000 and ¥4,895,500,000 (approximately $25,429,125 to $30,474,798.75 based on the current exchange rate of 1 JPY = 0.006225 USD). The lead underwriter for the offering is Daiwa.

Mamezo Digital Holdings

Mamezo Digital Holdings (Ticker: 202A.TKO) is an IT solutions provider offering “digital shift services”, AI cloud and robotics solutions. Mamezo Digital Holdings will list on June 27 on the Tokyo Stock Exchange Growth Market in Japan. The firm has priced its IPO at the top of the price range, ¥1,330 each, bringing the deal size to ¥6 billion (USD 38 million). The offering includes 50,000 primary shares and 4.48 million secondary shares, with an overallotment option of up to 607,500 secondary shares. The institutional books were more than 25x covered, with about 100 investors participating. Notably, up to 480,000 shares are allocated to designated purchaser Inaba Denki Sangyo. The offering is managed by SMBC Nikko, Morgan Stanley, and Mitsubishi UFJ Morgan Stanley. The proceeds will be used for working capital.

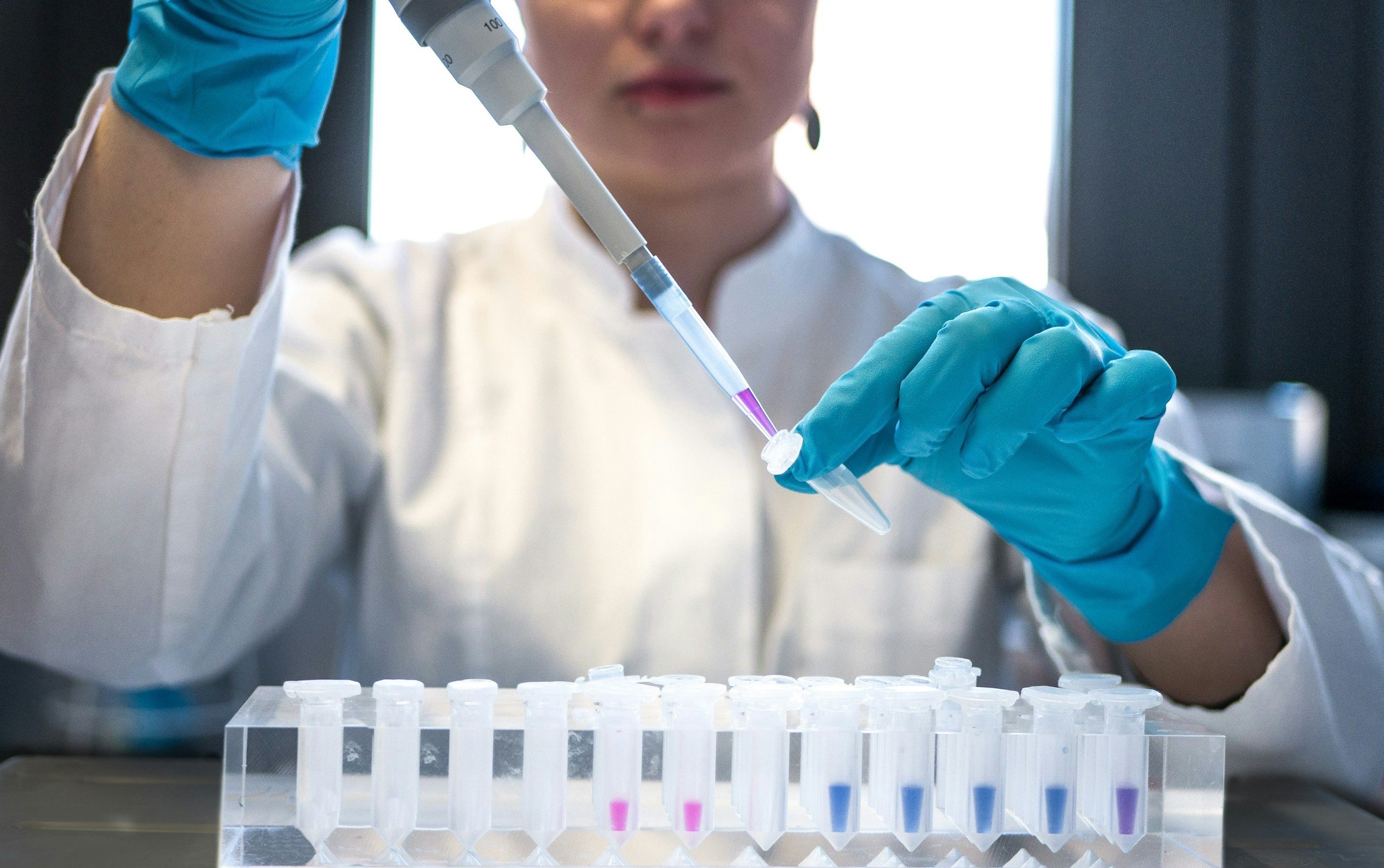

TAUNS Laboratories, Inc.

TAUNS Laboratories, Inc. (Ticker: 197A.T) is a pharmaceutical company specializing in the development, manufacturing, and sale of rapid diagnostic test kits for infectious diseases. The company's products are used by medical institutions for point-of-care testing to provide timely and accurate diagnoses. Founded in 1987, TAUNS Laboratories manufactures in vitro diagnostic test kits and research reagents, and its products are used in Japan and globally. The company will list on June 20, 2024, in Japan. TAUNS Laboratories is offering 24,253,500 shares at an IPO price of ¥460 per share. The total offer size is ¥11,156,610,000 (USD 77,484,264). The offering is managed by Daiwa, Mitsubishi UFJ Morgan Stanley Securities Co., Ltd., and other underwriters.

Astroscale Holdings Inc.

Astroscale Holdings Inc. (Ticker: 186A JP) is a Japanese space company specializing in offering commercial services for the removal of space debris. Astroscale Holdings Inc. will list on June 5 on the Tokyo Stock Exchange’s Growth market. The company has priced its IPO at 850 yen per share, the top end of the price range. The company plans to sell 24,929,200 shares, raising approximately 21.2 billion yen ($136.2 million). The estimated market capitalization at the time of listing is approximately 93 billion yen ($631.65 million). The offering is managed by Morgan Stanley, Mizuho, and Mitsubishi UFJ Morgan Stanley Securities Co., Ltd. Founder Mitsunobu Okada will offer 2.76 million shares in the IPO.

The proceeds from the IPO will be used to pay fees and expenses, for working capital, and for product development and R&D.

REZIL Inc

REZIL Inc (Ticker: 176A JP) is an electric distribution company based in Japan. The company specializes in providing solutions for the electric power supply chain, leveraging advanced digital technologies such as AI, IoT, and cloud computing to support a distributed energy ecosystem aimed at decarbonization.

REZIL Inc is set to list on the Tokyo Stock Exchange on April 24, 2024. The firm plans to offer 5.16 million shares, with a primary offering of 150,000 shares and a secondary offering of 5.01 million shares, priced between JPY 1,100 and JPY 1,200 per share. The total expected offer size is JPY 6.19 billion (approximately USD 40.77 million). Daiwa Securities Co Ltd is managing the offering. The IPO also includes a greenshoe option of 773,200 shares.

Material Group Inc

Material Group Inc (Ticker: 156A JP) is a Japan-based company operating in the advertising services sector. The firm specializes in providing comprehensive marketing communication support across various industries, focusing on enhancing the unique qualities of brands, products, services, and talents. Through its specialized expertise, PR-focused approach, and collaboration across its group entities, Material Group Inc aims to maximize potential and deliver tailored value to meet client-specific challenges.

The company is scheduled to list on the Tokyo Stock Exchange on March 29, 2024. Material Group Inc plans to raise JPY 5.77 billion (approximately USD 38.29 million) by offering 4.89 million shares at an expected price range of JPY 1,100 to 1,180 (USD 7.30 to 7.84). The IPO is managed by Nomura Securities Co Ltd.

Soracom Inc

Soracom Inc (Ticker: 147A JP) is a telecommunications company based in Japan, specializing in the wireless equipment industry. The company is set to list on the Tokyo Stock Exchange on March 26, 2024. Soracom Inc aims to raise JPY 9.4 billion (approximately USD 62.71 million) through its Initial Public Offering (IPO). The offer price has been set at JPY 870.00 (USD 5.8038) per share, with a total of 10.81 million shares being offered. The IPO includes 4.73 million primary shares, accounting for 43.81% of the shares offered, and 6.07 million secondary shares, constituting 56.19% of the offering. Additionally, there is a greenshoe option of 1.62 million shares available. The offering is managed by Daiwa Securities Co Ltd and Mizuho Securities Co Ltd.

Soracom provides Internet of Things (IoT) solutions, enabling connectivity for a wide range of devices through services such as cellular connectivity for SIM card and eSIM devices, Wi-Fi, Ethernet, or satellite connections, and satellite messaging. The company also offers a suite of data and protocol management services. Soracom's mission is to equip technical innovators with the tools necessary to build a more connected world, showcasing a commitment to supporting various industries through its comprehensive IoT platform.

Trial Holdings Inc

Trial Holdings Inc (Ticker: 141A JP) is a retail company that operates discount stores in Japan, offering a wide range of products including fresh foods, ready-made meals, housewares, and appliances. Trial Holdings Inc will list on March 21, 2024 in Tokyo. The firm is selling 22.85 million shares at the price of JPY 1,700. The expected market capitalization at offer is JPY 202.11 billion (USD 1.34 billion). The total offer size is JPY 38.85 billion (USD 258.24 million). The offering is managed by Citigroup Global Markets Japan Inc, Citigroup Global Markets Ltd, Daiwa Capital Markets Europe Ltd, Daiwa Securities Co Ltd, and Mitsubishi UFJ Morgan Stanley Securities Co. Trial Holdings operates more than 280 stores and plans to use the IPO proceeds for new store openings, renovations, logistics centers, expansion of the central kitchen and processing centers, and other operations.

Human Technologies Inc.

Human Technologies Inc. (Ticker: 5621 JP) is a Japanese software company specializing in cloud-based time management systems, PC authentication enhancement systems, and fingerprint authentication development kits. The company has a significant user base across various sectors, with notable clients like Tokyo Gas, Timberland Japan, and Kobe Steel.

Human Technologies Inc. is set to list on the Tokyo Stock Exchange on December 22, 2023. The firm is offering 3.29 million shares at an offer price of JPY 1,224 per share, with an expected market capitalization of JPY 11.14 billion (USD 74.40 million). Around 2.3 million shares of the offers are being sold by individual private investors. The total offer size is JPY 4.02 billion (USD 26.88 million). Daiwa Securities Co Ltd and Mizuho Securities Co Ltd are managing the offering.

Japan Eyewear Holding Co Ltd

Japan Eyewear Holding Co Ltd (Ticker: 5889 JP), operating in the Optical Supplies industry, was established as a holding company in 2021, aims for global expansion with a focus on high-quality, fashionable eyewear and a robust sales network of directly managed stores and dealers.

Based in Japan, the company specializes in manufacturing and selling eyeglasses and optical products under its subsidiaries, primarily through the Kaneko Optical and Four Nines brands. The IPO will take place on the Tokyo Exchange, with Japan Eyewear Holdings expecting to raise JPY 8.99 billion. The offering is managed by Daiwa Securities Co Ltd and Mitsubishi UFJ Morgan Stanley Securities Co.

Japan Eyewear Holdings is selling 6.61 million shares at an offer price of JPY 1,360 per share. The expected market capitalization at the offer is JPY 32.56 billion (approximately USD 217.46 million), and the total offer size is JPY 8.99 billion (approximately USD 60.01 million). The IPO is scheduled for November 16, 2023. The offering includes 21.19% primary shares and 78.81% secondary shares, with a greenshoe facility of 15.00%.

Kokusai Electric Corp

6525 JP

Offer Price JPY 1.84k

Pre Shoe Amount JPY 108.28B

Shares Offered 58.85M

Kusurinomadoguchi Inc

5592 JP

Offer Price JPY 1.70k

Pre Shoe Amount JPY 4.76B

Shares Offered 2.80M

Seibu Giken Co Ltd

6223 JP

Offer Price JPY 2.60k

Pre Shoe Amount JPY 13.70B

Shares Offered 5.27M