The IPOX® Watch - Pre-IPO Analysis: Strava

COMPANY DESCRIPTION

Strava, a fitness technology company, was founded in 2009 in San Francisco. Funding for new technology integrations and service upgrades is driven by investors such as Sequoia Capital, Madrone Capital Partners, and Jackson Square Ventures, among others. The app’s capabilities and services have grown through both corporate acquisitions and internal development, evolving from a simple workout mapping tool into one of the world’s leading platforms for athletes, now serving over 180 million users. Recent statements estimate around 50 million monthly active users. Through competition-style challenges and a broadly compatible platform agnostic to fitness tracking devices, Strava has surpassed the scope of most fitness and workout apps to become a quasi-social network for competitors of any level. It allows athletes to compete for King/Queen of the Mountain (KOM/QOM) titles on popular segments in their local area and compare splits and other data within the networking platform. The popular saying, "If it’s not on Strava, it didn’t happen," reflects the app’s strong presence in cycling and running communities. Boasting engagement rates of 2.23% per post compared to Facebook's 0.15%, growth in the app’s supported activities has expanded the user base from running and cycling to include rock climbing, swimming, skiing, and more.

BUSINESS MODEL

Strava operates on a freemium Software as a Service (SaaS) model, offering free access to its GPS tracking, activity logging, social feeds, and route discovery features. This entry-level access has been crucial for Strava’s efficacy as a social network and represents most of the user base. Strava’s subscription base offers an opportunity for growth, as only 3–15% of users opt for a paid subscription, which includes advanced analytics, personalized training plans, live performance feedback, AI-driven routing, offline maps, and safety features. Sacra estimates that as of 2023, 90% of Strava’s annual recurring revenue came from premium subscriptions, with event partnerships, ads, and the sale of aggregated user data to cities and urban planners filling the remainder. Official announcements during the Series F funding round in May 2025 indicated ARR had reached $500 million, with 80–90% subscriber retention indicating a strong product-market fit.

IPO

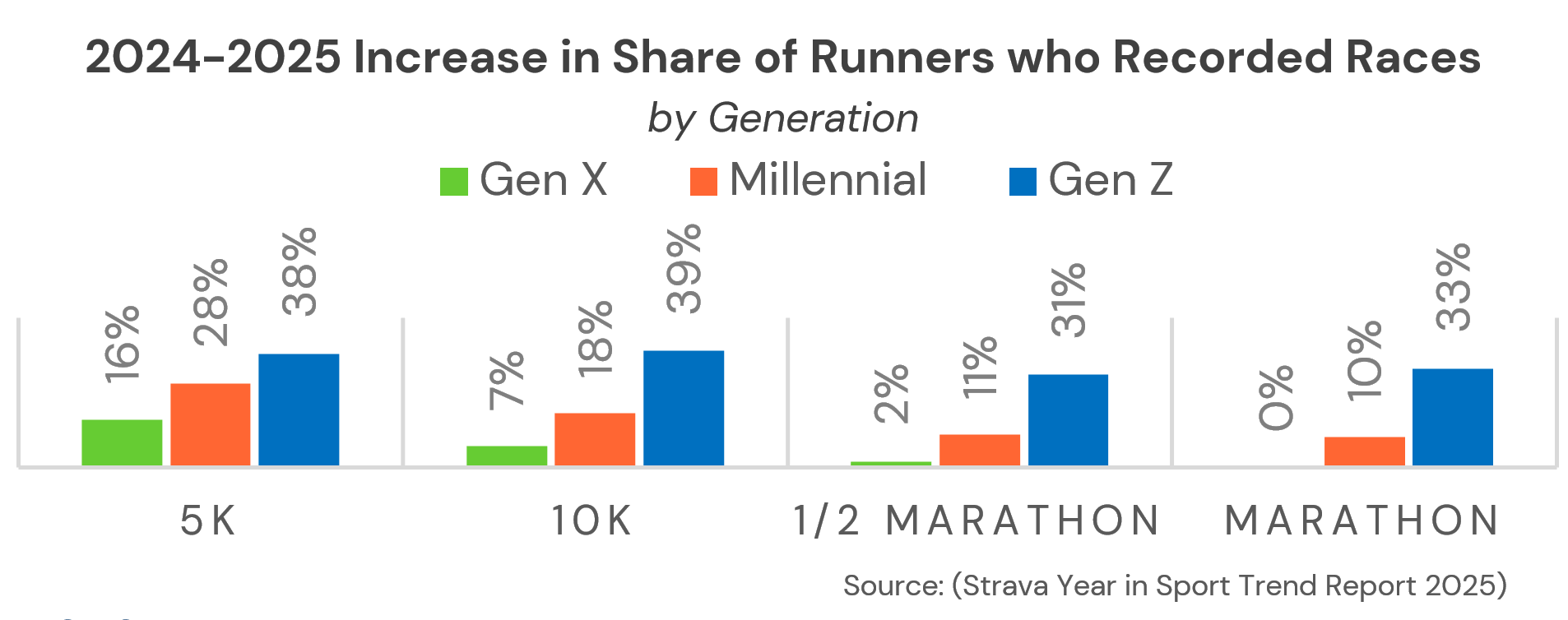

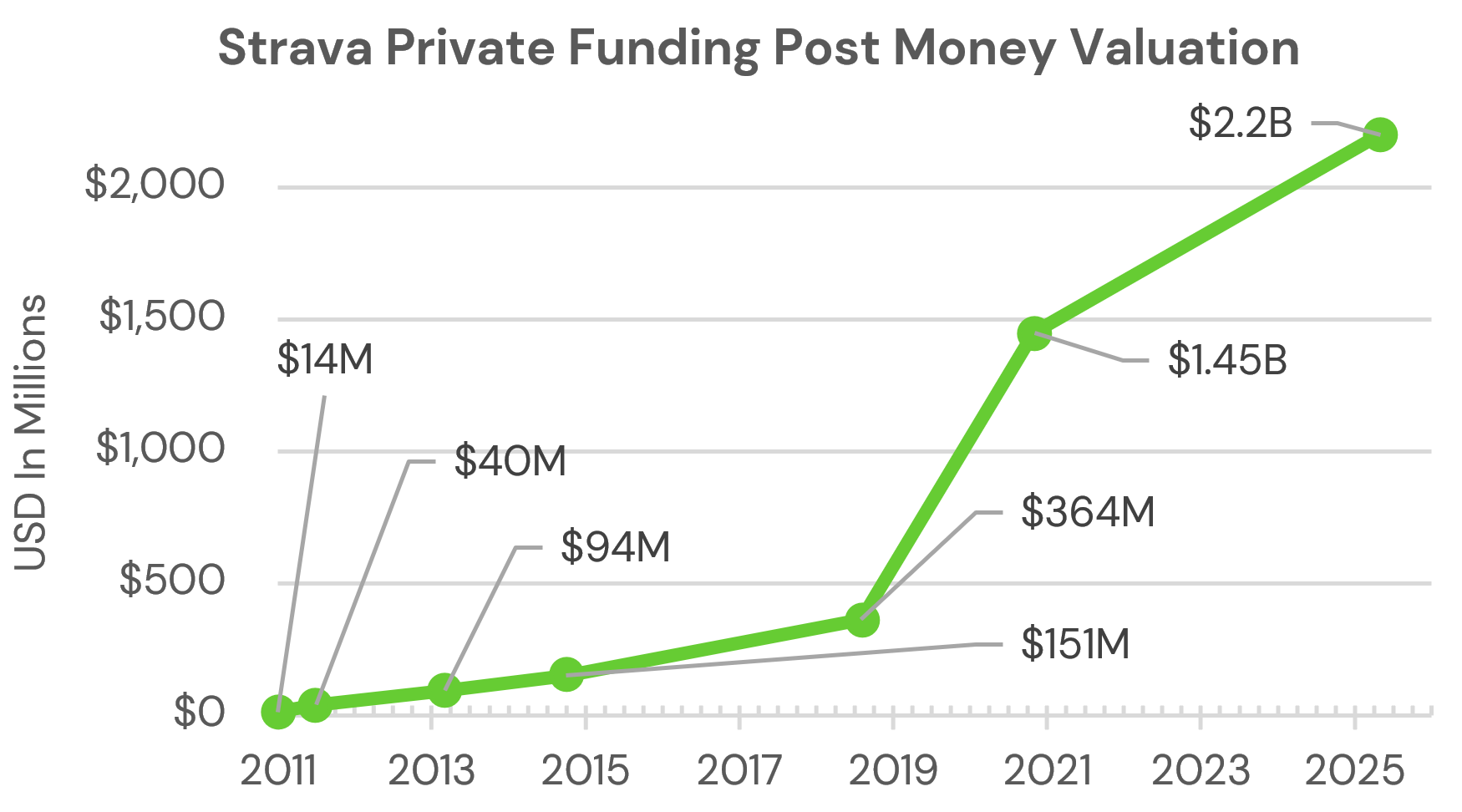

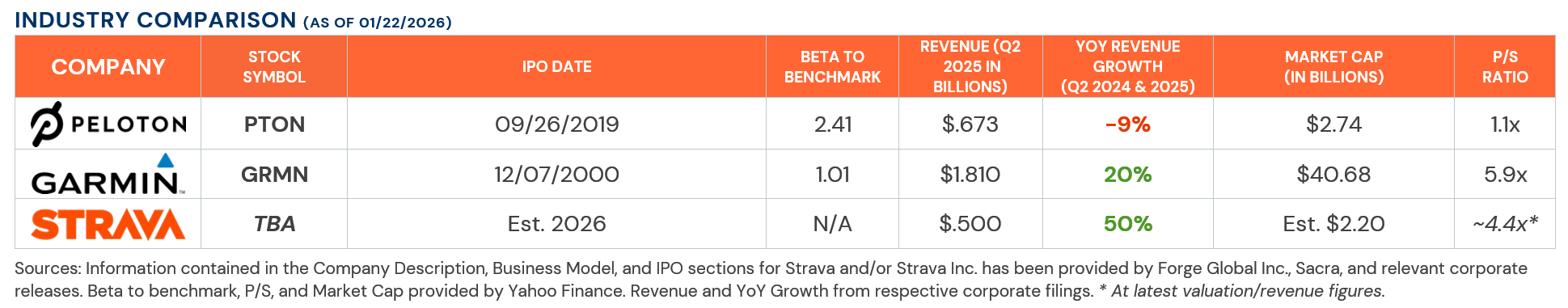

CEO Michael Martin announced plans to take Strava public in October 2025, filing a confidential S-1 in January 2026. The IPO’s lead underwriter is Goldman Sachs, and proceeds are earmarked for acquisitions and strategies to engage Gen Z users. Going into 2026, Strava continues to grow in usership, offerings, and community engagement following the COVID boost to the athletic market. This is driven by increased user data insights and AI integration following the acquisition of the app Runna. This continued growth deviates from similar gainers such as Peloton’s hardware-reliant model, which has continued to see declining revenue post-pandemic.

RISKS

Low conversion rates highlight a perceived gap in premium value, compounded by free AI tools offering similar features and rivals like Apple Fitness and Garmin Connect expanding their social ecosystems. Like hardware-driven competitors, Strava relies on discretionary spending for its largely optional service, which could become a vulnerability in tighter economic climates if subscription prices rise and the spread of revenue per user shrinks. Historical instances of exact tracking data have also created security issues on US military bases and for rural users.

OPPORTUNITIES

Strava’s growth and strategic positioning have strengthened following industry-wide post-COVID slumps thanks to its role as a broad data aggregator, compatible with over 400 devices, positioning the platform as the record keeper for competitions and elite training, with around 80% of Tour de France riders uploading their stats. Strava’s Year in Sport Trend report also highlights the social impact of the app, noting that 1 in 5 Gen Z users had gone on dates with someone they met exercising, in addition to a significant increase in “Strava Clubs” with hiking clubs up 5.8x, running clubs up 3.5x, and cycling clubs up 2.8x. Drafting on the rise of GLP-1 drugs and health-conscious consumer trends, Strava’s built-in agility and broad device compatibility offer an opportunity to monitor and share specific data with health care providers who aim to track their individual patients’ progress, or even sporting goods stores who want to stay ahead of the wear and tear on their clients’ gear. With these opportunities and more, the application and benefits of the data Strava provides can benefit consumers from athletics to health care.