SchusterWatch #827 (2/2/2026)

Jan. Review: Most IPOX® Indexes record strong first month of 2026 trading.

International Markets Lead: IPOX® Japan, International & MENA big Jan. winners.

Movers: SNDK, STX, LITE, GEV, 285A JP, LTM, MICC NA, CAN LN, VIK, TTAN.

IPO Window wide open: U.S. braces for flood of deals during first week of Feb.

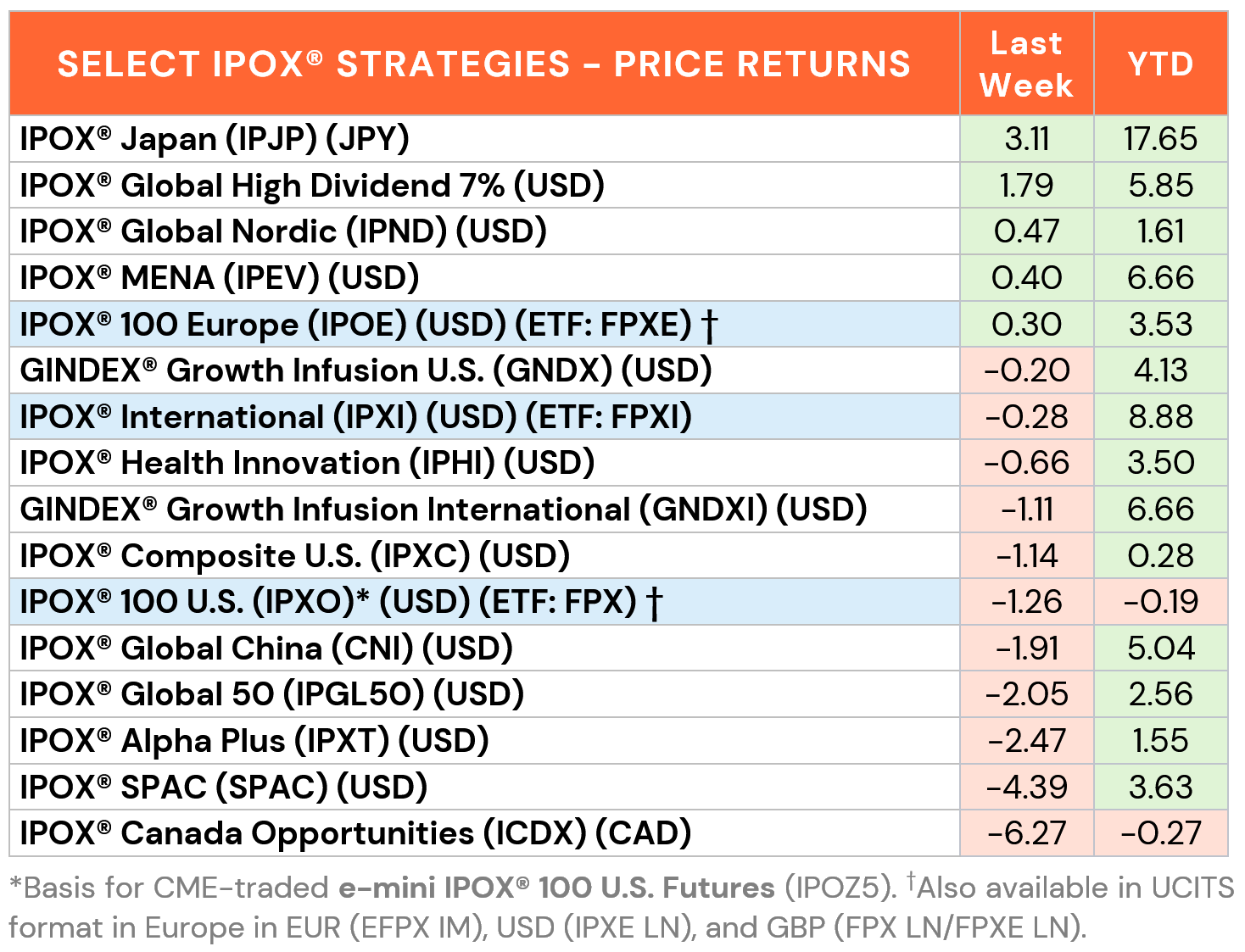

INTERNATIONAL LEADS DURING JANUARY: Amid somewhat weak U.S. bonds, range-bound trading in the USD, earnings, and tumultuous moves in global Metals and Miners, the IPOX® Indexes finished the month on a mixed note. International exposure continued to outpace IPOX® U.S. holdings, with a number of portfolios producing market-beating returns in the process.

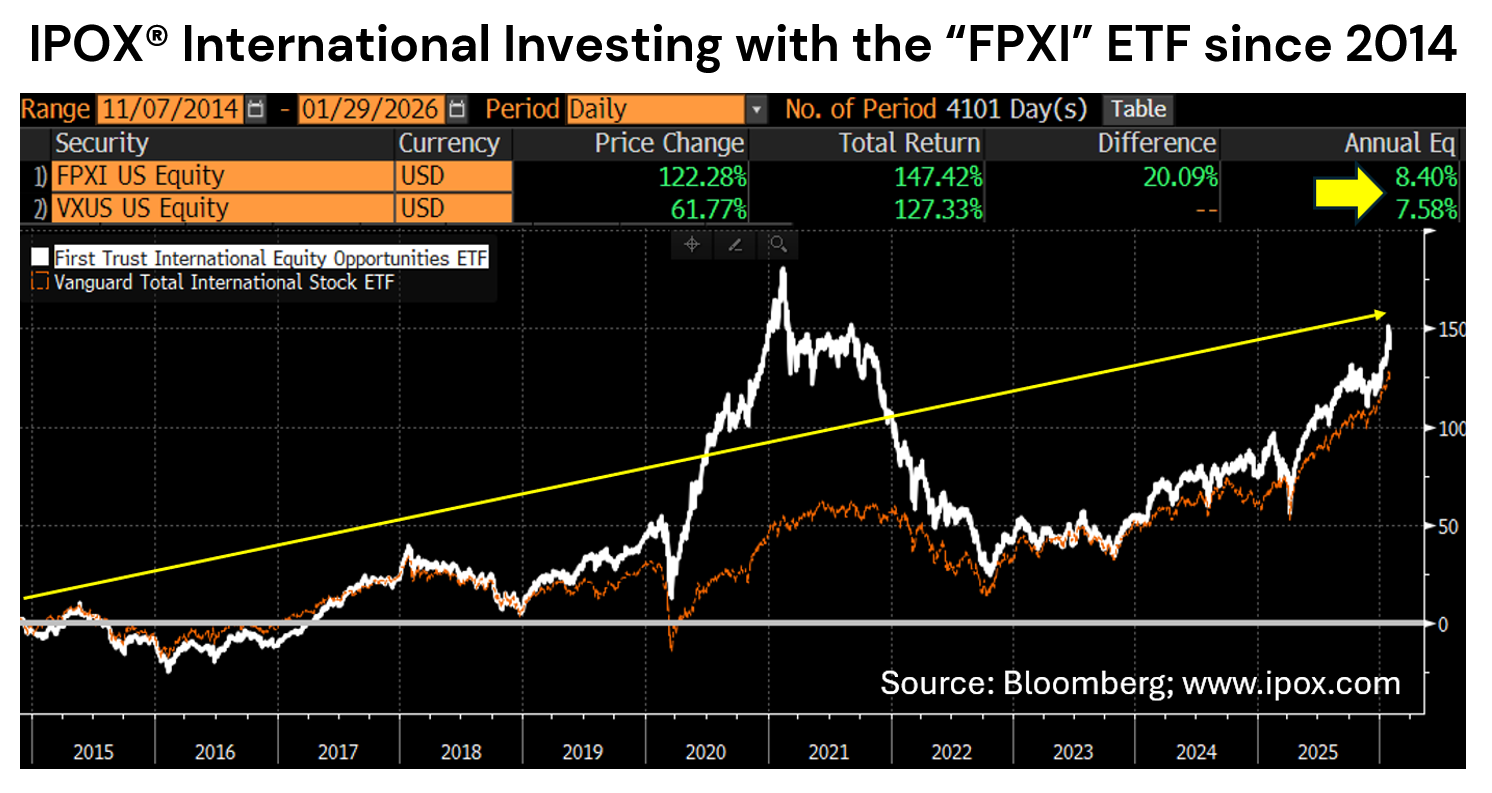

BIG SURGE IN IPOX® JAPAN (IPJP) & MENA (IPEV) PROPELS INTERNATIONAL (ETF: FPXI): Ranking top of the list amongst the IPOX® Strategies was the IPOX® Japan (IPJP), which soared +3.11% to +17.65% YTD, a massive +1303 bps ahead of the Japanese market as measured by the Tokyo Stock Price Index (TOPIX). Here, the portfolio benefited from its tilt towards semiconductor-related exposure, firms in critical industries, and highly liquid large and recently listed firms including Kioxia (285A JP: +23.22%), Advantest (6857 JP: +8.39%) and Rakuten Bank (5838 JP: +3.24%). We also note another exceptional week for travel-related exposure, including cruise line operator 04/24 IPO Viking Holdings (VIK US: +5.27%) and 07/24 IPO LATAM Airlines (LTM US: +3.44%), which both closed out the trading week at a fresh weekly all-time high. This helped propel the IPOX® International (ETF: FPXI) to a gain of +8.88% YTD, outpacing the MSCI World ex. US (MSWOU) by +420 bps during the month. In the IPOX® Europe (ETF: FPXE), corporate updates and strong momentum propelled French TV giant and 12/2024 Spin-off Canal+ (CAN LN: +16.50%) as well as Ben & Jerry’s maker Magnum Ice Cream (MICC NA: +5.44%) to close at a fresh post-listing high.

IPOX® U.S. UPDATE: Exceptional earnings reported by a number of portfolio holdings were not able to mitigate the negative impact of profit-taking across a number of last year’s strongly performing stocks. This came amid fears related to the impact of AI on software stocks in general and Google’s Project Genie announcement on Friday in particular.

As a consequence, the IPOX® 100 U.S. (ETF: FPX) declined -1.26% last week to -0.19% YTD, giving back just a fraction of last year’s massive relative gains. Big outliers to both sides included storage devices makers SanDisk (SNDK US: +21.62%), Seagate (STX US: +17.80%) and Lumentum (LITE US: +15.52%), while social media platform Reddit (RDDT US: -17.64%), trades software platform ServiceTitan (TTAN US: -15.30%) and data security firm Rubrik (RBRK US: -14.80%) sank.

THE IPOX® SPAC INDEX: The Index fell -4.39%, bringing YTD performance to 3.63%. Battery firm Amprius Technologies (AMPX US: +11.37%) surged following bullish analyst coverage. Quantum computing company D-Wave Quantum (QBTS US: -17.21%) fell further amid the broader sell-off across quantum names. No SPACs announced merger targets or completed business combinations, while ten new SPAC IPOs were launched in the U.S. during the week.

ECM DEALS & OUTLOOK: Global IPOs saw 19 new listings raising $3.02 billion to record an average first-week gain of +65.75% (Median: +38.14%). While Korean hydrogen firm Deokyang Energen (0001A0 KS: +248.50%, $51m) and Chinese grocer Busy Ming Group (1768 HK: +73.71%, $471m) recorded significant appreciation, U.S. trading proved mixed. Golden Dome-linked Satellite firm York Space Systems (YSS US: -1.15%, $629m) closed slightly lower. In Reuters, IPOX® Associate Lukas Muehlbauer noted that the deal signals a receptive market for 2026 defense stocks ahead of a potential SpaceX IPO, though he cautioned regarding near-term volatility tied to government spending patterns (Read more). Other notable debuts included German energy equipment supplier ASTA Energy (1AST GR: +36.27%, $197m) and Brazilian fintech PicPay (PICS US: 0.00%, $434m).

On this week’s calendar, 12 significant IPOs target over $7 billion in deal volume. U.S. deal flow is headlined by data center equipment manufacturer Forgent Power Solutions (FPS US, $1.5b) and ad-tech platform Liftoff Mobile (LFTO US, $711m), alongside retailer Bob's Discount Furniture (BOBS US, $350m). A wave of biotech listings includes hair loss pharma Veradermics (MANE US, $200m), inflammation specialist AgomAb Therapeutics (AGMB US, $200m), and oncology firm Eikon Therapeutics (EIKN US, $300m). In Reuters, IPOX® Associate Muehlbauer noted the premium attributed to Eikon's CEO and Nobel-backed platform (Read more here). Investor attention also turns to Jennifer Garner-backed Once Upon A Farm (OFRM US, $198m). Speaking to Bloomberg regarding the “Hollywood IPO Curse”, IPOX® CEO Schuster warned that celebrity-backed deals historically underperform (Read more here). Amid high activity in Hong Kong, major listings include pork producer Muyuan Foods (2714 HK, $1.4b) and energy drink maker Eastroc Beverage Group (9980 HK, $1.3b).