Reuters: IPOX® Associate Lukas Muehlbauer comments on York Space Systems’ NYSE Debut

Reuters features IPOX® Associate Lukas Muehlbauer’s commentary on York Space Systems’ $4.75 billion NYSE debut. Muehlbauer notes that the successful listing signals a receptive market for defense and space stocks in 2026, setting the stage for the highly anticipated SpaceX IPO. He also analyzes York’s acquisition of ATLAS Space Operations, cautioning that despite the push into software services, the stock will likely remain volatile and sensitive to government spending news in the near term.

Reuters: IPOX® Associate Lukas Muehlbauer analyzes Eikon Therapeutics' Strategic Positioning and IPO Launch

Reuters features IPOX® Research Associate Lukas Muehlbauer’s analysis on Eikon Therapeutics' upcoming $908 million IPO. Muehlbauer highlights the premium placed on CEO Roger Perlmutter’s leadership and the company’s Nobel Prize-backed drug discovery platform. He further contrasts Eikon with recent listings like Aktis Oncology, explaining how Eikon aims to overcome historical toxicity challenges in immune-stimulating drugs. This listing signals renewed momentum for the biotech sector following a challenging 2025.

Bloomberg: IPOX® CEO Josef Schuster Comments on Risks of Celebrity-Backed IPOs

Bloomberg features IPOX® CEO Josef Schuster’s analysis on the "Once Upon a Farm" IPO, co-founded by Jennifer Garner. Discussing the "Hollywood IPO Curse," Schuster warns that celebrity-backed deals historically underperform, citing an "eight out of 11" failure rate. He urges investors to prioritize operational expertise and management resumes over star power. The article underscores the critical importance of evaluating business fundamentals versus celebrity marketing when assessing new public listings.

Reuters: IPOX® VP Kat Liu comments on Tariff Risks in Bob's Discount Furniture IPO

Reuters reports that Bob's Discount Furniture is targeting a $2.5 billion valuation in its upcoming NYSE IPO. IPOX® VP Kat Liu analyzed the retailer's position regarding trade risks, noting that the company’s shift away from China sourcing helps mitigate specific tariff concerns. However, Liu cautioned that the stock might still experience volatility driven by broader market sentiment regarding freight costs and global trade, rather than direct margin impacts.

Reuters: IPOX® Associate Lukas Muehlbauer comments on Forgent Power’s AI-Driven IPO Valuation

Reuters reports that Forgent Power is targeting an $8.8 billion valuation in its upcoming NYSE debut. IPOX® Associate Lukas Muehlbauer provided expert analysis on the listing, characterizing the company’s heavy focus on data centers as a rare "direct play" on AI spending. Muehlbauer noted that while the growth narrative is strong, the proposed 10x price-to-sales ratio asks investors to pay a significant premium over industry peers.

Reuters: IPOX® Research Associate Lukas Muehlbauer Comments on EquipmentShare’s Nasdaq Debut

Construction tech firm EquipmentShare surged in its Nasdaq debut, reaching a $7.2 billion valuation. In coverage by Reuters, IPOX® Research Associate Lukas Muehlbauer analyzes the deal, highlighting the company’s tech-driven growth potential against legacy competitors. Muehlbauer also notes the sensitivity of their expansion plans to the interest rate outlook. Read the full update on the latest addition to the U.S. IPO landscape.

Reuters: IPOX® Associate Muehlbauer Analyzes BitGo's Debut Amidst Crypto Market Headwinds

IPOX® Associate Lukas Muehlbauer was featured in a recent Reuters article analyzing BitGo’s successful NYSE debut. Muehlbauer notes that BitGo serves as a key bellwether for the 2026 crypto IPO market, launching against the headwinds of a recent sector selloff. He highlights that BitGo’s positioning as a profitable, regulated infrastructure play - rather than a pure token play - helps insulate it from daily Bitcoin volatility.

Benzinga: IPOX®-linked ETFs FPX and FPXI Highlighted as IPO Market Heats Up in January 2026

As the U.S. IPO market heats up in January 2026 with over 20 new listings, Benzinga identifies IPO-focused ETFs as efficient tools for investors. The article highlights the First Trust U.S. Equity Opportunities ETF (FPX) and First Trust International Equity Opportunities ETF (FPXI), both tracking IPOX® indices, as key funds to watch. These strategies offer systematic exposure to the largest U.S. and international IPOs and spin-offs during their critical growth phases.

Barron's: IPOX® CEO Josef Schuster Comments on BitGo's IPO and Market Selectivity

Barron's features IPOX® CEO Josef Schuster in an analysis of BitGo's upcoming $2 billion NYSE debut. Highlighting the crypto custodian's profitability as a key strength, Schuster notes that while financials are solid, recent market volatility suggests investors remain disciplined. He cautions that despite the hype, there won't be "indiscriminate demand" for the stock. The piece also examines the broader 2026 IPO landscape, including upcoming listings like EquipmentShare.

Reuters: IPOX® VP Kat Liu Comments on EquipmentShare.com’s $6.4 Billion IPO Target

Reuters reports that construction tech firm EquipmentShare.com is targeting a $6.41 billion valuation in its upcoming U.S. IPO. IPOX® VP Kat Liu provided expert commentary in the article, noting that the firm’s T3 technology layer adds a "narrative premium" compared to traditional rental competitors. Liu also highlighted the company’s impressive growth trajectory, predicting "healthy demand" driven by the credibility of its narrative as it prepares to list on Nasdaq.

Reuters: IPOX® Associate Muehlbauer Comments on BitGo's $1.96 Billion IPO Target

A recent Reuters article discusses BitGo's target of a $1.96 billion valuation in its upcoming IPO. IPOX® Associate Lukas Muehlbauer provides expert commentary, noting that recent market scrutiny has driven a "flight to quality," positioning BitGo as a defensive play due to its regulatory status. The piece also highlights BitGo’s strategic timing amid small-cap momentum, supported by its recent pivot to profitability and OCC approval as a national trust bank.

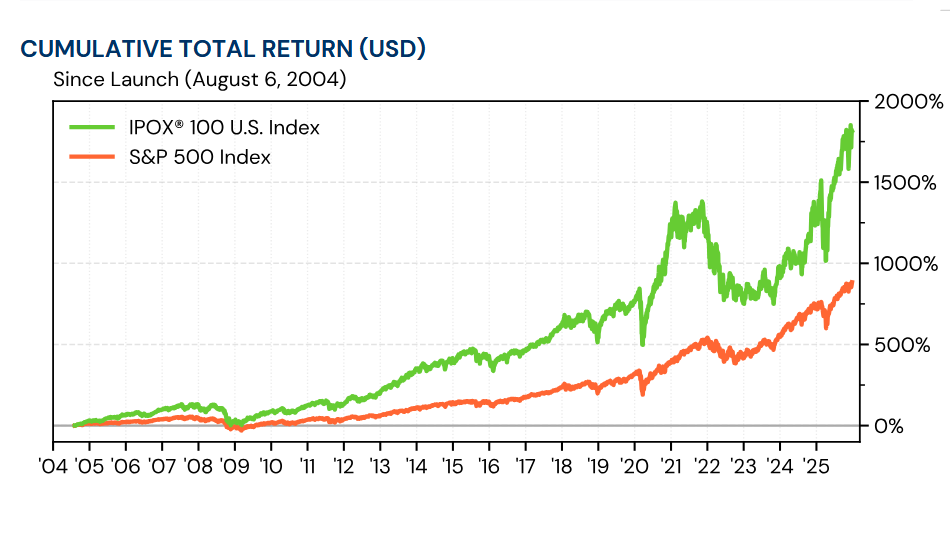

Seeking Alpha: IPOX®-linked FPX ETF Recognized for Superior Long-Term Performance

A recent Seeking Alpha analysis by Fred Piard identifies the First Trust US Equity Opportunities ETF (FPX), which tracks the IPOX® 100 U.S. Index, as the market's "most compelling" IPO fund. Piard notes that the ETF has significantly outperformed competitors and benchmarks since 2006, driven by the index’s unique methodology that captures value from both new listings and corporate spin-offs. He concludes that the fund's rules-based approach offers investors superior long-term returns compared to other strategies in the space.

Reuters: IPOX® VP Kat Liu Comments on Forgent Power's IPO Filing and Sector Risks

Reuters features IPOX® VP Kat Liu’s analysis of Forgent Power Solutions’ robust IPO filing. Amid an 84% revenue surge, Liu discusses the strategic advantage of early 2026 timing and the constructive influence of strong peer performance. She provides critical insight into potential risks, including raw material costs and supply chain sensitivities, as the electrical equipment maker prepares for its NYSE debut.

Reuters: IPOX® Associate Muehlbauer comments on Eli Lilly’s backing of Aktis Oncology’s IPO

In a recent Reuters article, IPOX® Associate Lukas Muehlbauer commented on Aktis Oncology’s upsized IPO, targeting a $945 million valuation with Eli Lilly as an anchor investor. Muehlbauer highlights that this backing validates Aktis’ technology and positions the firm as a strategic target in an M&A-driven sector. He views this as a positive signal for a selective biotech rebound in 2026, where investors increasingly favor proven, late-stage pipelines.

Bloomberg: IPOX® Analyst Lukas Muehlbauer Comments on the Evolution of European IPO Markets

Bloomberg features IPOX® Analyst Lukas Muehlbauer on the trajectory of European listings since the 2021 IPO boom. Discussing InPost SA’s takeover offer, the article highlights the shift from a hype-driven seller’s market to a scrutiny-heavy buyer’s environment. Muehlbauer emphasizes that investors now prioritize credibility over "growth at all costs," fundamentally changing how new offerings are valued in the current market landscape.

Benzinga: IPOX® 100 U.S. Index (FPX) Leads with Medline Addition Amid IPO Revival

In a recent article, Benzinga featured the First Trust U.S. Equity Opportunities ETF (FPX), which tracks the IPOX® 100 U.S. Index, for being the first to add Medline Industries after its massive IPO. The piece highlights the fund's systematic, rules-based methodology, noting a 40% gain this year and a five-star Morningstar rating. This underscores how IPOX® indices provide investors with diversified, liquid access to top-performing new public companies like Medline.

Reuters: IPOX® VP Kat Liu highlights brand recognition in Andersen Group’s NYSE debut

In a recent article by Reuters, tax advisory firm Andersen Group saw its shares surge 31% during its NYSE debut. Kat Liu, Vice President at IPOX, noted that investors are responding to the firm's unique brand legacy and earnings stability. With a $2.3 billion valuation, Andersen plans to use its new public currency for aggressive global acquisitions, signaling a revitalized momentum in the U.S. IPO market following recent interest rate cuts.

Reuters: IPOX® Analyst Muehlbauer Discusses Wealthfront's IPO and Fintech Market Selectivity

IPOX® Research Analyst Lukas Muehlbauer was featured in Reuters discussing Wealthfront’s $2.63 billion Nasdaq debut. While the fintech raised $484.6 million, its flat opening highlighted ongoing market caution. Muehlbauer noted that "investors are still selective," distinguishing between high-profile wins and mixed broader performance. His commentary underscores the critical nuance required when analyzing shifting sentiment within the recovering fintech IPO landscape.

Reuters: IPOX® CEO Josef Schuster Comments on Lumexa Imaging's IPO and Market Trends

In a recent Reuters article, IPOX® CEO Josef Schuster analyzes the successful $462.5 million IPO of Lumexa Imaging amidst the year-end market rush. Schuster highlights that while investor appetite exists for the "right deal," there is notable caution regarding sectors with poor post-IPO returns, such as Silicon Valley-backed crypto and AI ventures. Read more about his insights on the current selective IPO landscape.

Reuters & Equipment Finance News: IPOX® Analyst Muehlbauer Comments on EquipmentShare.com IPO Filing

Construction tech firm EquipmentShare revealed significant revenue growth in its recent US IPO paperwork. IPOX® Research Analyst Lukas Muehlbauer provided key insights on the filing, noting the company’s sensitivity to interest rates due to capital deployment for its rental fleet. Muehlbauer also discussed the broader market trend, suggesting companies are rushing filings to avoid potential volatility and uncertainty surrounding Federal Reserve leadership changes in 2026.