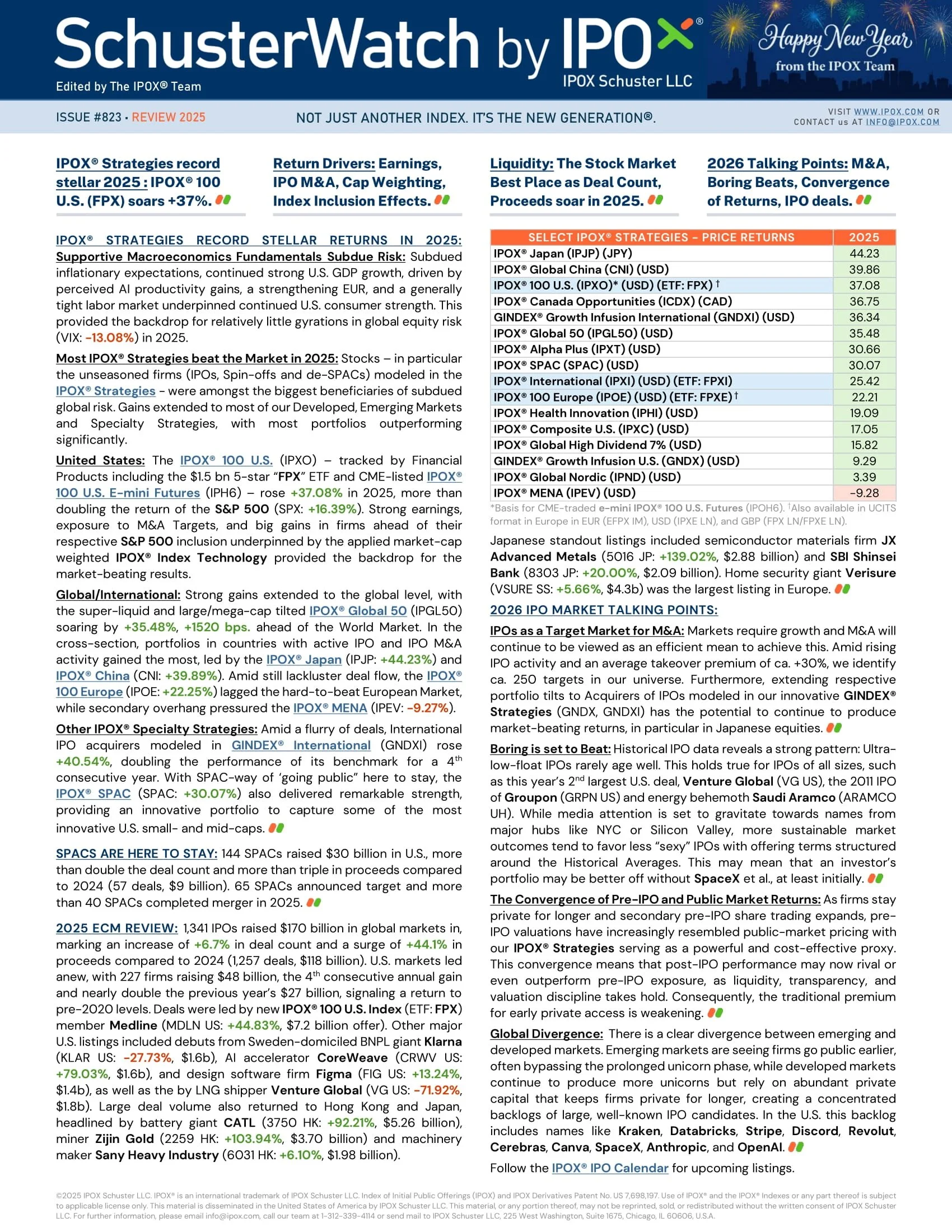

Not Just Another Index.

It’s The New Generation.®

We offer specialized solutions for investors seeking exposure to New Listings - a proxy for economic growth and innovation.

New: The IPOX® High Dividend 7% Strategy

An Innovative Index Strategy

combining Income & Growth!

Upcoming Global IPOs

The IPOX® Newsletters

IPOX® in the News

Reuters features IPOX® Associate Lukas Muehlbauer’s commentary on York Space Systems’ $4.75 billion NYSE debut. Muehlbauer notes that the successful listing signals a receptive market for defense and space stocks in 2026, setting the stage for the highly anticipated SpaceX IPO. He also analyzes York’s acquisition of ATLAS Space Operations, cautioning that despite the push into software services, the stock will likely remain volatile and sensitive to government spending news in the near term.

Reuters features IPOX® Research Associate Lukas Muehlbauer’s analysis on Eikon Therapeutics' upcoming $908 million IPO. Muehlbauer highlights the premium placed on CEO Roger Perlmutter’s leadership and the company’s Nobel Prize-backed drug discovery platform. He further contrasts Eikon with recent listings like Aktis Oncology, explaining how Eikon aims to overcome historical toxicity challenges in immune-stimulating drugs. This listing signals renewed momentum for the biotech sector following a challenging 2025.

Bloomberg features IPOX® CEO Josef Schuster’s analysis on the "Once Upon a Farm" IPO, co-founded by Jennifer Garner. Discussing the "Hollywood IPO Curse," Schuster warns that celebrity-backed deals historically underperform, citing an "eight out of 11" failure rate. He urges investors to prioritize operational expertise and management resumes over star power. The article underscores the critical importance of evaluating business fundamentals versus celebrity marketing when assessing new public listings.

Reuters reports that Bob's Discount Furniture is targeting a $2.5 billion valuation in its upcoming NYSE IPO. IPOX® VP Kat Liu analyzed the retailer's position regarding trade risks, noting that the company’s shift away from China sourcing helps mitigate specific tariff concerns. However, Liu cautioned that the stock might still experience volatility driven by broader market sentiment regarding freight costs and global trade, rather than direct margin impacts.

Reuters reports that Forgent Power is targeting an $8.8 billion valuation in its upcoming NYSE debut. IPOX® Associate Lukas Muehlbauer provided expert analysis on the listing, characterizing the company’s heavy focus on data centers as a rare "direct play" on AI spending. Muehlbauer noted that while the growth narrative is strong, the proposed 10x price-to-sales ratio asks investors to pay a significant premium over industry peers.

The IPOX® Update

SpaceX dominates headlines with a potential $1.5 trillion IPO and xAI merger. Defense firm York Space Systems debuts at $4.75 billion, with IPOX® Associate Lukas Muehlbauer noting the sector’s strength. Muehlbauer also analyzes AI infrastructure play Forgent Power and biotech Eikon Therapeutics. IPOX® VP Kat Liu discusses tariff risks for Bob's Discount Furniture, while IPOX® CEO Josef Schuster warns against celebrity-backed listings. Elsewhere, software firm Anaplan preps a return, and JD.com’s property arm files in Hong Kong.

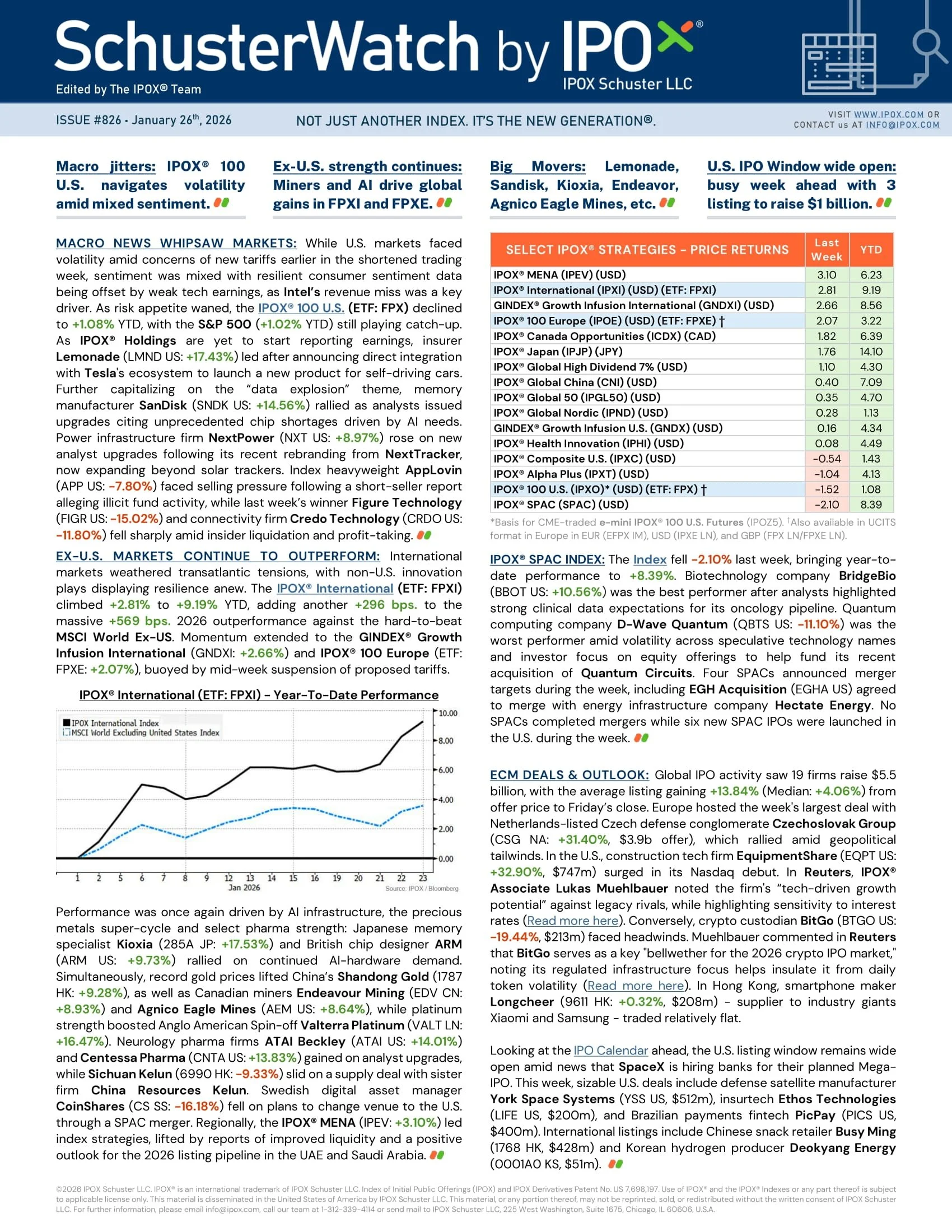

SpaceX accelerates blockbuster IPO plans by lining up four Wall Street banks, while construction tech firm EquipmentShare hits a $7.2 billion valuation in its Nasdaq debut. IPOX® Associate Lukas Muehlbauer analyzes the deal and crypto custodian BitGo’s volatile start as a 2026 bellwether. The U.S. pipeline grows with filings from prime broker Clear Street and Brazilian fintech Agibank, plus potential moves by Jersey Mike’s and Ledger. Globally, European tank maker KNDS prepares a €25 billion listing, and Alibaba’s chip unit explores a spin-off.

The U.S. IPO pipeline accelerates as construction tech firm EquipmentShare targets a $6.4 billion valuation, with IPOX® VP Kat Liu highlighting its "narrative premium." Crypto custodian BitGo eyes a $2 billion debut, drawing commentary from IPOX® CEO Josef Schuster and Associate Lukas Muehlbauer on market selectivity. Brazilian fintech Agibank files for a $1 billion listing. Globally, Czech defense giant CSG launches a massive €30 billion IPO, while Chinese chipmaker Montage Technology preps a $22 billion Hong Kong debut.